What would a joyous retirement look like for you? Whether it’s travelling the world, learning new skills, volunteering or spending more time with friends and family, most people don’t get to fulfil all of their dreams. That seems to be the consensus of statisticians and academic studies. In the UK alone, 2.1 million pensioners are defined as being in poverty, according to Age UK. That means living on less than 60% of the UK’s median household income.

Many more don’t meet the definition of living in poverty, but they’re certainly not living their dream retirement. There are concerns that around 10 million UK residents could be heading for insufficient retirement income.

In today’s more transient job market with the demise of final salary pensions, individuals must prepare for their own financial security. We can no longer rely on employers and the state for a comfortable retirement.

So why do so few people reach financial independence? For some, it’s simply not possible to build enough wealth. Health issues can be a barrier to earning money, as can spending many years as a carer. Staying at home to look after children and run the household is an unsalaried job with no pension contributions.

For many, though, it comes down to unhelpful financial behaviours and, perhaps, a lack of financial education. Looking back on my own working life, I recognise decades of poor money management on my own part, even as a bank employee and financial adviser.

One key reason for these unhelpful behaviours comes down to an observation by British naval historian and author, C. Northcote Parkinson.

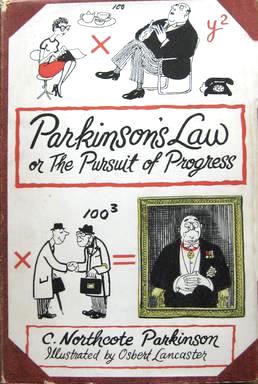

The Pursuit of Progress by C. Northcote Parkinson

Parkinson’s 2nd Law

“Expenditure, or money paid out, rises to meet income”

In other words, no matter how much people earn, they tend to spend the entire amount – and a little more besides.

Cyril Northcote Parkinson is better known for his first law, which was published in the Economist in 1945. It stated that “work expands to fill the time available for its completion”. It later became the focus of his book The Pursuit of Progress.

The principle applies to income and expenditure, as well as work. When you look back over your working life, did annual pay increases and promotions mean more money for spending? Lifestyle creep is hard to resist in a consumerist society.

Financially literate people will use at least part of a pay increase to boost their savings habit and nurture their wealth.

So, if we know this “law” exists, what can we do about it? Here are some thoughts:

1. Overcome Parkinson’s Law

Consciously break Parkinson’s Law daily. This is the secret to financial success.

You know the phrase “live within your means”? It’s accepted wisdom that you should spend no more than you earn. But most people have mortgages, loans and credit cards to deal with. That’s on top of all the usual monthly expenses. It’s hard to spend less than you earn consistently. This is because unexpected bills come in. House repairs, car breakdowns, irresistible offers on holidays or other tempting deals.

You might begin each month with the best of intentions. You try to be careful with your spending, then save what’s left over at the end of the month. But for the vast majority of people, this approach doesn’t work. It never worked for me and it probably won’t work for you either, so you need to find another way to overcome Parkinson’s Law.

2. Pay Yourself First

This is a financial behaviour that says “I matter”. You prioritise your long-term financial wellbeing and create more of a balance against the relentless short-term bills, purchases and entertainment.

Read how to pay yourself first for a powerful pathway towards financial freedom.

3. Savour Your Spending

This is a phrase I use to help encourage mindful spending of both money and time. It’s about being conscious of spending decisions and appreciating every transaction you authorise. Think “budgeting with gratitude”.

Earlier this year, I went through a phase of counting calories to help lose a few pounds. It worked, although I did feel hungry all the time, at least for the first week or two.

What I realised, though, is that I started to appreciate every single piece of food. Even yoghurt scraped off the foil lid, and healthy stuff like granola! Because I was logging it and tracking the calorie intake, I came to savour every single morsel.

The same principle can apply to money. If you log your spending and focus on keeping money aside for the future, you come to appreciate every Pound, Dollar or Euro that “goes out” or “stays in”.

Read more about how to savour your spending and help your finances flourish.

4. Design Your Future

Once you recognise the power of Parkinson’s Law, you can make conscious choices to avoid it . You can choose to actively overcome that law every single day.

Develop the habit of paying yourself first and begin to savour your spending.

Then give yourself permission to dream. Visualise how you would like your future to look and know that you are taking steps towards it. Allow momentum to build and enjoy the compounding effect of regular savings and time.

Summary

Nearly anyone can reach financial independence, given enough time and the right financial behaviours. It’s a question of how much time you have and how well you overcome Parkinson’s Law.

Financial coaching and planning can help you develop the financial habits you would like to have, and then align these with your desired future lifestyle. Get in touch if you’d like to chat about how this could work for you.

Production

Production