GroWiser Financial Coaching has a new website!

I’m delighted to announce that, after many months of designing, writing, editing, and refining, I now have a professionally designed website. This online shop window is a huge milestone for my business and I must admit, I’m feeling pretty proud of it.

I hope that I’ve managed to get across what I do as clearly as possible, whilst providing useful resources and information. No doubt things will continue to evolve and change over time, but for now, I’m very happy and I’d love for you to take some time and explore the site. I’ve explained some of the key pages below.

What’s my story?

I came up with the idea of GroWiser Financial Coaching 4 years ago, just as the Covid pandemic was taking hold. By July 2021, it had become a full-time business and a new chapter of my life had begun.

The whole ethos behind my work is to empower individuals and couples to grow – and not just financially. Combining financial education, self-knowledge and the motivation to take action is my recipe for a uniquely successful life.

My years of experience as a Chartered Financial Planner and a Learning & Development specialist bring together technical knowledge with an understanding of how people learn. It’s often emotions and behaviours that can stall progress and that’s where coaching comes in.

You can read more about my values and background in the “About Graham” section of my website.

Coaching and planning

I often speak about the difference between financial coaching and financial planning. It’s tricky because there is no universal, formally adopted definition for either. And generally speaking, except for those who actually do the job, no-one really understands what either service entails.

I define financial coaching as:

“A collaborative partnership of guidance and support which inspires client-led behavioural change in the pursuit of financial wellbeing”

That’s a bit of a mouthful, but it’s about helping individuals and couples to take control of their financial lives. That can involve exploring the emotions of money, as well as getting practical with things like money management and financial education.

Coaching, by definition, should be a short-term interaction. The idea is to empower people to become confident and capable enough to no longer need a coach. In its purest sense, it should be client-led.

Financial planning, on the other hand, is more about the long-term. It’s generally process-driven and mostly led by the planner or adviser. It can be more analytical and focusses on long-term financial security and life planning. Good financial planners will use lifetime cashflow modelling software and take account of your overall circumstances.

Both of these services are hugely valuable, but they are different to financial advice. That’s when a regulated financial adviser will make specific and personal recommendations on financial products and can implement solutions and manage money on your behalf.

I provide coaching and planning services, but not advice. It’s the complete break from product providers, commissions and percentage base fees that allows me to remain entirely neutral. I support clients to make their own financial choices, rather than making suggestions.

Being free of regulatory overheads keep expenses lower and makes my services more accessible. With less than 10% of the population working with an adviser, there are a lot of people to help.

You can find out more about my packages in this section of the website.

How to search my blogs

Each week, I write a new blog or update an existing blog on a variety of topics. These span across the spectrum from practical to emotional and behavioural aspects of money.

You can filter blog searches into the following topics:

Financial Coaching:

General information on what financial coaching is, how it can help and what to look for in a good financial coach.

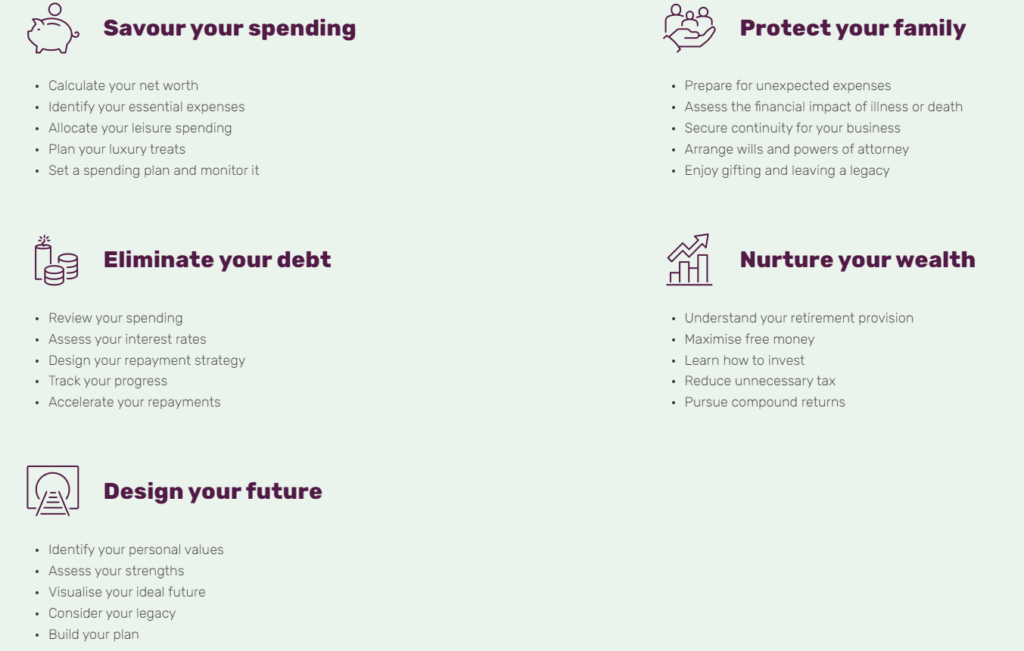

Savour Your Spending:

Making the most of your money and your time, from budgeting and net worth calculations to gratitude and work-life balance.

Protect Your Family:

This is all about good financial housekeeping, like making wills and powers of attorney, building an emergency fund and making sure you have adequate insurance.

Eliminate Your Debt:

It’s not always about getting rid of debt, but it’s certainly about using it effectively and making sure it works in your favour. That includes building up your credit score.

Nurture Your Wealth:

This section includes learning how to invest for the first time, tracking down lost pensions, making the most of tax-free allowances and working towards financial independence.

Design Your Future:

This is about long-term strategy and how money can be used to support your ideal future life. It’s about understanding whether your finances are on track to enable retirement, career changes and other life choices.

Life Planning:

This category focuses less on money and more about what’s important in life. You’ll find articles that touch on personal values, avoiding regrets in later life and making the most of your time, talents and energy.

Visit the blog section

Resources section

This section of the website contains a selection of comprehensive guides on topics like making your first investment, financial protection and how to get a better work-life balance. You’ll also find spreadsheets to calculate your net worth and help build a Spending Plan.

If you want to get a sense of how your pensions are shaping up for the future, try the Financial Health Check tool. Enter details of your financial goals for the future, together with existing pension arrangements and then play around with the retirement spending calculator.

This produces a graphic to indicate how well on-track you are for the retirement you’d like to enjoy.

By entering your email address, you’ll receive a detailed report with general hints and tips to improve your financial health. All of these resources are available to download for free.

Visit the resources section

Financial professionals

Did you know that I also work with organisations to provide training, coaching and consultancy support?

There could be scope for regulated advisers to enhance their client journey by working with me to provide dedicated coaching sessions. Or I can help you understand what training and process changes could lead to a more coaching-led approach in your advisory business.

Take a look at this page for a couple of examples of where my services have extended beyond work with my own clients.

Summary

I hope my new website tells the story of why I set up as a financial coach and how my work helps individuals, couples and organisations.

If you haven’t already, I’d love for you to join my weekly newsletter list and if you’d like to chat about the work I do, please get in touch.

Finally, a word of thanks to the fabulous Yardstick Agency. This is the amazing team of designers, content writers, copy-editors and technical wizards who all came together to build my new website. This is definitely a project I could not have done on my own!

Production

Production