The thought of complicated calculations and financial projections can be enough to make you reach for the gin. It’s so much easier to spend a couple of hours dreaming about the future, rather than actually creating a visual financial plan.

The trouble with personal finance, is that it’s set in a world of numbers and assumes that we are all logical and numerate. That’s often far from the truth. Decisions about money are often driven by emotions, more than logic. Perhaps more often than we’d care to admit.

So how does financial planning help bring together the creativity of imagination and the logic of mathematics?

What is a financial plan?

Relatively few people have a written financial plan, but when you think about it, how else can you gain clarity on your financial future? Crucially, a plan is something tangible. It should be well thought-out, with creativity and detail. That’s what differentiates it from a vague idea or a dream.

A goal without a plan is just a wish

A robust financial plan brings together art and science. There’s the numbers and logic side of things, of course, but just as important is your lifestyle, both now and how you would like it to be in the future. It should consider how you enjoy spending your time as well as your money.

The use of lifetime cashflow modelling software brings this to life and helps to create a tangible plan. The creativity of graphs and charts can really help you to visualise your financial trajectory and understand your situation better.

One challenge with financial planning is that it necessarily looks many years into the future. There are so many variables to how our lives could end up, it may seem almost pointless trying to plan.

This is where it’s useful to reflect on the words of US president Dwight D. Einsenhower:

“Plans are worthless, but planning is everything”

Dwight D. Einsenhower

It’s the experience of building the plan that adds most value. It brings clarity to your aspirations for the future, but it also allows you to really analyse where you are now, and how your money is being used.

The finished plan itself is not entirely worthless, but it will quickly become out of date. This is due to a great many assumptions, which cannot possibly all be accurate.

In 1950, Eisenhower wrote a letter to a U.S. diplomat in which he used a military-oriented version of the saying to an anonymous soldier.

“. . . I always remember the observation of a very successful soldier who said, “Peace-time plans are of no particular value, but peace-time planning is indispensable.”

So a great time to create a financial plan is when things are going well. Ironically, this is when you might not feel much motivation to get on with it!

How does lifetime cashflow modelling work?

Specially designed software will analyse your income, expenses, property, pensions and investments. The more sophisticated programmes will build in tax calculations and assumptions around inflation, interest rates and investment returns.

Hundreds of calculations work away in the background and help to create high impact, visual graphics stretching years and decades into your financial future.

It’s these visuals that can really help to understand your financial trajectory. Put simply, it can help indicate one of three possible outcomes:

- You may run out of money at some point in the future

- You may run out of time before you run out of money

- You have just the right amount to last a reasonable estimate of your lifetime

Many people find they are heading for the 2nd outcome, but they just don’t know it yet. If this is you, a plan can give ‘permission to spend’ or provide the confidence to retire earlier than expected. Or even inspire you to support loved ones or causes that are important to you.

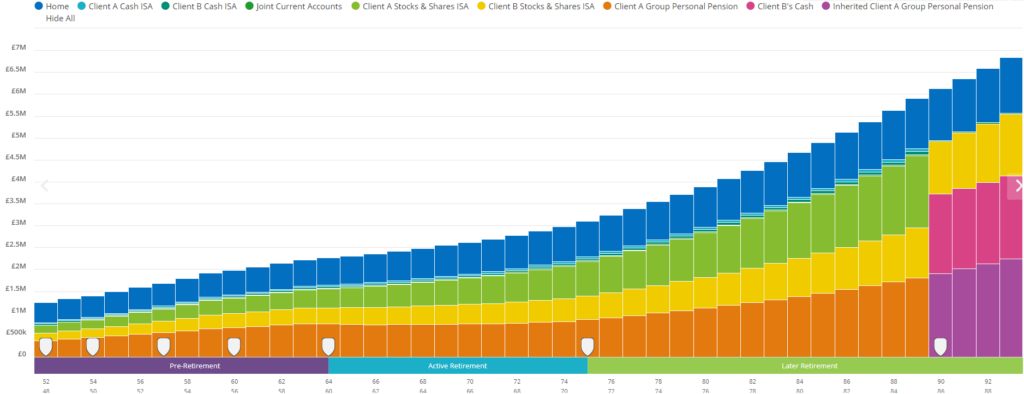

The ‘assets’ graph below shows how a client’s property, savings and pension continue to grow indefinitely. This is the projection after meeting all of their projected lifestyle expenses, as shown by the ‘cashflow’ graph 2 underneath it.

Graph 1: Assets

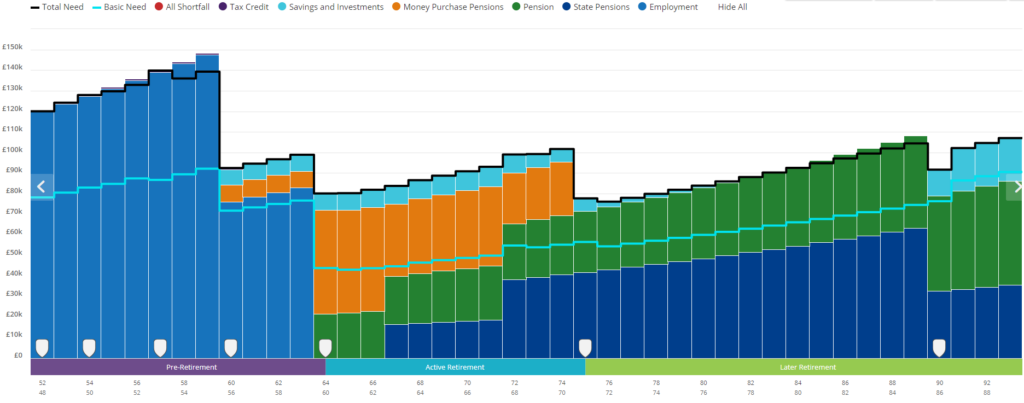

Graph 2: cashflow

This indefinite growth risks an inheritance tax burden or worse, the possibility of regrets later in life. We’ve all heard of stories about people working too hard all their lives, then not living long enough to enjoy the fruits of their labour.

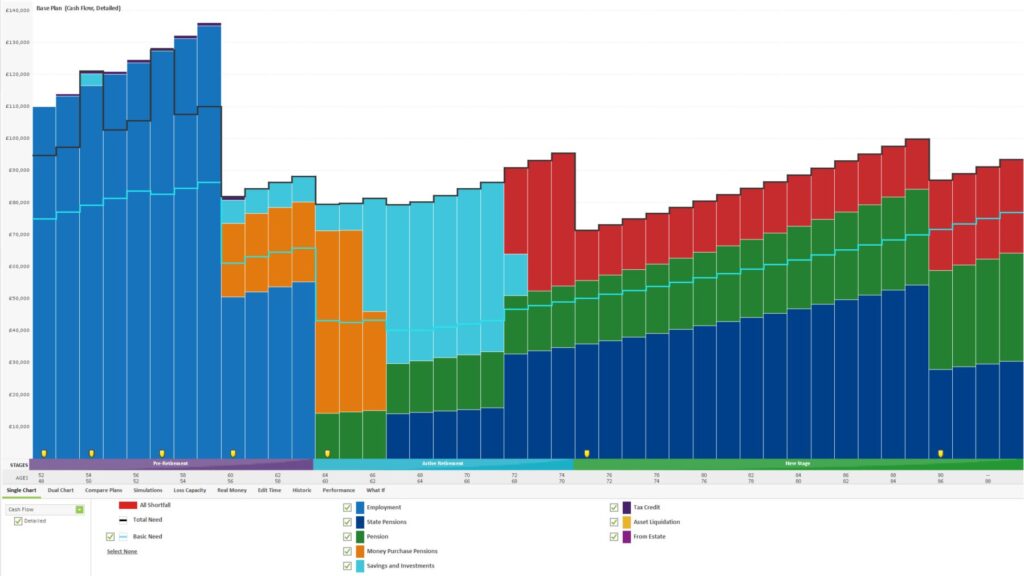

For those heading towards a shortfall, the sooner you create a plan and become aware of the shortfall, the sooner you can take action. The red section shown in the cashflow graph below indicates this couple may run out of money at ages 72 and 68. They’ll still have pension income, of course, but not enough to maintain their desired lifestyle.

Lifetime cashflow with shortfall

Being able to see this early enough means there’s time to do something about it.

What scenarios can be tested?

This is where things start to get really interesting. Once you have a ‘Base Plan’ of where things are currently headed, you can begin to ask “What If” type questions. Here are some actual questions that people have asked during the financial planning process:

- Could we afford to retire 2 years earlier?

- Is voluntary redundancy a viable option?

- Can I leave my job to start a business?

- What would be the financial impact if my partner died?

- Is it better to make mortgage over-payments, or invest instead?

- Should we take tax-free lump sums from our pensions?

- How would higher than expected inflation affect me?

- Could I take a year-long sabbatical to go travelling?

- What would be impact of paying for long-term care?

- Should we start gifting to the family now to help save inheritance tax?

The list could go on and on. What scenarios would you like to test for yourself?

Can you build a financial plan without a financial adviser?

Yes, it’s possible, and there are basic some DIY cash-flow modelling apps to help with this. You could take a look at:

But it’s worth considering the value you could gain by working with a professional. The financial planning process could be considered an investment in yourself and your future happiness.

Firstly, a good financial planner or coach will have the skills to help you really think about how you would like the future to be. Don’t underestimate the value of this. As humans, we tend to suffer from short-term bias and can find it very hard to visualise a long-term future.

Secondly, there’s the technical aspect of building a plan. How do you account for inflation and what assumptions should you make about investment returns? Many people also need help understanding the value of their pensions, insurances and investments.

Thirdly, it’s worth recognising that the biggest factor in your own financial future is not the technicalities of pensions and investments, but rather your financial habits and behaviours.

Having a robust breakdown of your spending now, and how that could change in the future, can be the single biggest factor in a financial plan. And if you want to change those habits and behaviours, you’ll benefit from working with a coach, or at least a financial planner who has been trained in coaching skills.

It’s worth remembering that creating a plan is one thing, but its execution is another. Regulated financial advisers can make personal recommendations on specific financial products, if required. They can also implement their advice by liaising directly with financial services providers.

For those who prefer a DIY approach, it’s easier than ever to manage your own investments and pensions. You can benefit from the guidance and support of a financial coach, but ultimately, the choice and ongoing management of products would be your own responsibility.

Summary

Having a well thought out financial plan can provide the framework for many financial and lifestyle decisions.

The visual aspect can help bring the numbers to life and the ability to explore different scenarios gives flexibility. Remember, it’s the planning that’s most valuable, not the plan itself. Consider it an ongoing process and one that you should review at least annually.

Let’s finish with the words of some clients, who described their financial planning experience:

“I am clearer on what the future holds and have confidence on my thinking and money spending / saving. Tips to help me clarify and balance with what I need to invest / save to live the life I want.”

“We were at a bit of a crossroads with regards to our finances and Graham helped us enormously to look at where we currently are and sort out a long term financial plan working towards retirement and our kids (hopefully) leaving home! Using the financial planning tool very much helped us to clarify an investment strategy and his coaching approach worked well for us.”

“After an initial meeting where I found Graham to be an excellent listener and a supportive skilled financial coach, together over a short series of meetings we built my financial plan and Graham gave me targeted advice and coaching on key decisions. This was a very empowering process with a tangible output at the end (a ‘lifetime’ financial plan). I now feel well set up for retirement and more confident in handling my investment decisions.”

If you’d like to find out how financial planning could work for you, book yourself in for a 30-minute chat.

Production

Production