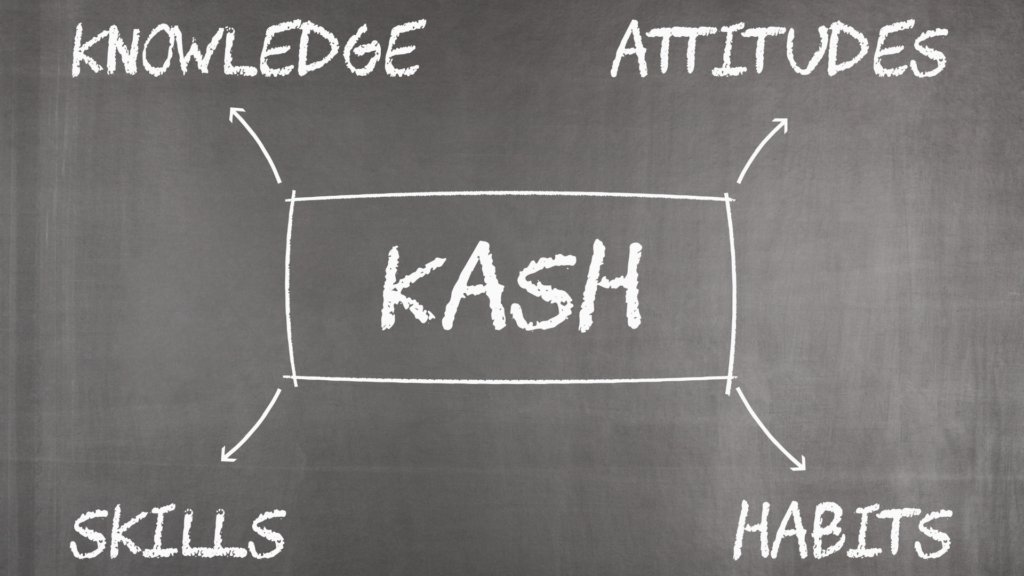

Money can often be the source of arguments, anxiety and judgement. Lack of it can prevent life goals from being achieved, too much can attract criticism and envy. The near absence of financial education in schools and workplaces is often blamed for a lack of financial knowledge, but that’s only part of the problem. It’s your ‘money habitudes’ that can have a big impact on your financial success, or otherwise.

Lack of knowledge can be fixed with some effort. Information is easily available nowadays if you have the motivation to learn, and over time, financial skills can be developed.

What can be trickier to address are habits and attitudes – your money ‘habitudes’. Studies have indicated that our thoughts, feelings and attitudes towards money are pretty much formed by age 7. What we hear and see from our parents, carers and teachers at a young age tends to form life-long beliefs and behaviours.

Money Habitudes

Syble Solomon, who specialises in the psychology of money, created the Money Habitudes game. This is an engaging and fun way to explore how you feel and behave around money.

The Money Habitudes website offers a range of games and solutions to help uncover your money personality. For $14.95, an interactive on-line card game produces a comprehensive report on your money habitudes. It comes with ideas on how you might make adjustments to how you think and behave around money.

There are six Money Habitudes, summarised below. Which ones do you recognise in yourself?

Carefree

Money isn’t a priority and you just let life happen. With this habitude, others might see you as easy-going, flexible, immature, irresponsible.

Advantages can include optimism, adaptability, good at sharing with others. But you may have a tendency to lose track of money or possessions. You may lack some confidence or feel frustration that things don’t always work out.

Planning

Money helps you achieve goals. Others might see you as responsible, accomplished, driven, conservative.

On the plus side, you’re likely to make long term decisions based upon your values. You probably have money set aside for emergencies and you may have a sense of wellbeing.

Drawbacks can be impatience with others who do not meet your standards. You may feel frustration with the idea of helping others who do not plan. Possibly, you may notice difficulty in responding to new situations.

Status

Money helps you present a positive image and you may come across as generous and impressive. On the other hand, others may see you as superficial or insensitive.

Strong first impressions can be an advantage with this habitude and you may be attentive to what’s important to others. It’s likely that you will be generous with your gifts and you will enjoy returning favours.

Difficulties can include giving a false impression of wealth, unwise spending decisions and possible money secrets.

Spontaneous

Money encourages you to enjoy the moment. You may come across as daring, fun-loving, open-minded, impulsive, unconcerned with consequences.

There are positives with this outlook on money, including the ability to respond quickly to opportunities, enjoy adventures and easily gain attention and recognition.

Drawbacks may include getting into debt for things you don’t need or feelings of being powerless with budgeting. You may feel guilt or shame about over-spending, debt or being over-generous to others.

Giving

Money helps you feel good by giving to others. Others are likely to see you as thoughtful, charitable, enabling.

Advantages are likely to includes strong values and convictions, ethics and integrity. You may have the ability to anticipate the needs of others and enjoy life based on non-materialistic values.

But it’s not without potential difficulties, including disappointment if your gifts are not appreciated or reciprocated. You may feel intolerance of people with different lifestyles and a tendancy to sacrifice your own needs for the future security of others.

Security

Money helps you feel safe, secure and in control. Others may see you as thrifty, prepared, suspicious, cheap.

Big on budgets, goals and savings, you will benefit from delayed gratification and will have the peace of mind of having money available for emergencies. You’ll spend wisely now in order to have more choices in the future.

The downsides to this habitude can include the avoidance of risk. You may get stuck in a secure job you don’t love. It could be difficult for you to take advantage of unexpected opportunities, or you might tend to save so much that you can’t fully enjoy life now.

Summary

None of these habitudes are better than the other, and they’re not necessarily good or bad. Knowing more about them, however, can build a good awareness of how you make decisions about money and help you appreciate the different viewpoints of others. For example, if you have a partner that doesn’t always see eye to eye when it comes to money, this can be a great exercise to try with each other.

When used within a programme of financial coaching, it can really help to build self awareness and confidence around money. Exercises like this can unravel years of poor financial management and takes strides towards financial wellbeing.

If you would like to explore the benefits of financial coaching in more detail, why not arrange a free 30 minute chat?

Production

Production