If you truly nurture your wealth, you’re in the minority. You may well nurture your garden, your children and hopefully your health. But the idea of growing assets can seem vulgar to some, undeserved by others. A whole range of emotions come in to play with this topic, but really, it’s about investing for your future self.

This subject is sadly neglected in the education system, but it has become more important than ever. With the demise of final salary pensions and the looming cost of social care as the population gets older, it’s hard to predict your financial future.

Responsibility for your financial security rests with you. Fortunately, it’s relatively easy to get started and nearly all the information you need is available online for free. Never before has it been so straight forward to invest for your future and with that, comes exciting opportunities.

There are pitfalls and dangers, of course, so a helping hand from a financial adviser or coach can help prevent mistakes. Here are 5 steps to getting on the right track.

1. Understand your retirement provision

In your 20s and 30s, it feels unimaginably far away. Then retirement begins to niggle at the back of your mind in your 40s. And when you reach your 50s, the prospect becomes real. Whatever stage you’re at, it’s key to know how you’re placed financially. You can’t nurture something that you don’t appreciate or understand.

Don’t put this off until “nearer the time”. The quicker you get started, the easier it is. It’s never too early to begin planning for retirement. Both of my children have had pension plans since their first birthdays.

Pay attention to the annual pension statement from your employer and if you don’t understand it, get help. Investing a bit of time and effort into understanding your pensions will help you know whether any further action needs to be taken.

If you’ve lost track of old pensions from previous employers, your money will still be there. It’s estimated that almost £20 billion of ‘lost’ pensions are languishing around, because people have not updated their contact details or have simply forgotten about them. The government has a pension tracing service, which can help you get started by clicking the button below:

Remember, it’s not just pensions that can be used to prepare for retirement. You may have property, ISAs, a business or other assets that could be used to support your future lifestyle. The trick is to get a clear picture of all your existing assets and debts, work out how much more you need, then nurture your wealth to bridge the gap.

2. Maximise free money

It’s frightening how many employees are effectively turning down a pay rise. It’s understandable, but frightening.

I’m referring to matched pension contributions. This is where employers boost the retirement savings of employees who choose to pay more than the minimum. Unfortunately, many workers never increase their pension contributions above the minimum. As a result, millions are missing out on this ‘free money’.

This is frightening because it means businesses retain extra profit, whilst employees build up less financial security.

It’s understandable, though, because we all suffer from ‘Present Value Bias’. This is the tendency to place more value on money available to us now, rather than money at some point in the future. And, of course, access to pension money can seem an awful long way in the future.

Lethargy also kicks in here. If you need to think about increasing your pension contributions, then make a decision about it and then take action to make it happen, it’s much less likely that you’ll do it. That’s why the government introduced auto-enrolment. It helps tackle lethargy in an era when final salary pensions have all but closed to most workers.

Currently, auto enrolment rules dictate that a minimum of 8% of qualifying earnings are paid into your pension. At least 3% must come from the employer, with the rest deducted from your gross salary. Some employers are more generous and could even contribute more than the minimum 8%. This can make it tempting not to pay any additional contributions yourself and this is where apathy can become dangerous.

Don’t be influenced by minimum requirements. Think more about maximums. Try to take full advantage of any matched contributions from your employer. It’s the easiest way to get an immediate pay rise for your future self to enjoy.

3. Learn how to invest

When I first started training to become a financial adviser more than 20 years ago, the whole business of investing was quite cumbersome. Nowadays, it’s much easier. You can learn loads from the internet and you can invest at a much lower cost too.

The difficulty is in knowing where to look and how to choose the best option for you. Often, the choice can be overwhelming and the technical jargon off-putting.

It’s not without its dangers, too. Starting small and gradually building up experience as your portfolio grows is one thing. Making one big decision on a large amount of money is another. In situations like that, seeking out independent, regulated advice may be money well spent.

Either way, it’s good to build an understanding of the basics. You can’t just rely on a solid final salary pension and a state pension to see you comfortably through life. Take individual responsibility for your financial future.

Fortunately, it’s easy to get started and there are apps that allow you begin investing with relatively small amounts. More information can be found on comparison sites like Money to the Masses and Boring Money.

For a gentler introduction to the basics of how to nurture your wealth, try the government’s Money Helper service.

4. Reduce unnecessary tax

For most people, it’s easy to save tax efficiently. Individual Savings Account (ISA) and pension contribution limits are often sufficient. Some additional planning might be needed if you have a very high salary. Or you may need to seek advice if you receive a large amount of money, for example, an inheritance, sale of a business or a lottery win.

ISAs and pensions might be all you need if you’re on the journey of wealth accumulation. Both of these options keep your money safe from income tax and capital gains tax, although there are pros and cons to each.

There’s a great YouTube video from PensionCraft that explains the tax implications of both in more depth.

ISAs have various options to choose from and I touch on the main types in my earlier blog here.

5. Pursue compound returns

This famous quote by Albert Einstein suggests that it’s worth taking some time to understand the value of compounding returns.

But it’s not just understanding the concept that matters. You need time, patience, and some determination to enjoy the results.

This takes us back to the concept of ‘Present Value Bias’ that I mentioned earlier. It’s difficult to stay focussed on the distant future because something will always crop up in the present. There are unlimited reasons not to stay the course with investing, some practical, some emotional.

One of the biggest investment mistakes is repeated consistently by millions across the globe, every year. That is to withdraw money in a panic when something unexpected happens, like a stock market tumble. You need to learn to overcome these fears and stick with the plan. Compounding returns only work if you can stay the course over many years.

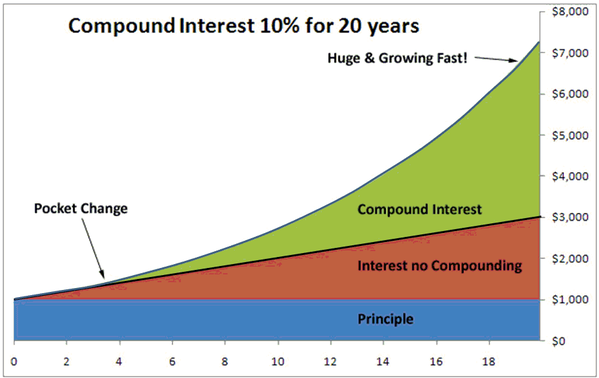

I like the graph below from the alearningaday blog, which shows that to begin with, you might only get ‘pocket change’ in the way of returns. But after several years, the returns become exponential. The longer you can stay invested, the better. Therefore, the earlier you begin, the better. (Note: this graph is purely to demonstrate the effect of compound interest. It takes no account of stock market volatility).

It doesn’t have to be complicated, but forget the excitement of ‘get rich quick’ schemes and ‘risk free’ offers of big profits. Go for slow and steady compound returns over time. Accept that principle, and you’re well on the way.

Summary

Financial coaching can address both the practical and emotional steps needed to nurture your wealth. Think of it as having a money mentor to guide you through the practical steps and a life coach to help you reflect on your own behaviours, motivations and emotions.

If you’d like to make a start, get in touch below.

Production

Production