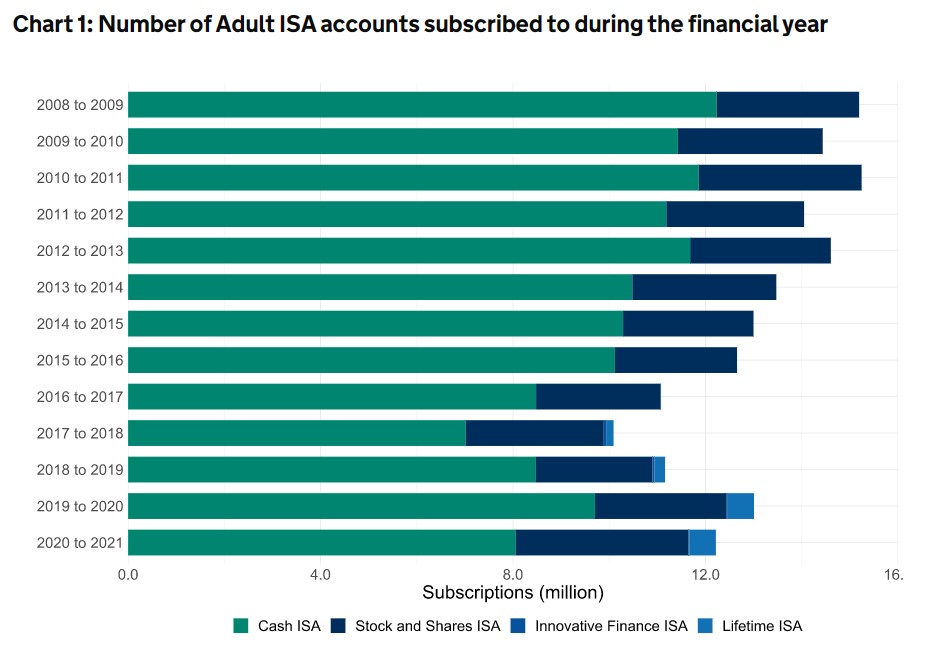

Despite the headline, Cash ISAs remain the clear favourite for tax-free savings in the UK. The graph below, from the Office of National Statistics (ONS), shows their popularity in the green colour. Stocks and shares ISAs, in dark blue, are a clear 2nd. Lifetime and Innovative Finance ISAs trail far behind. But with interest rates trailing well below the rate of inflation and the current tax rules on savings income, are Cash ISAs really the best place for your savings?

Let’s look at some key considerations to help you decide if Cash ISAs are worth it.

What are Cash ISAs?

Cash ISAs are really just tax-free bank or building society accounts, although you can also open them with National Savings & Investments.

Some offer instant access, where the interest rate rises or falls when the Bank of England base rate changes. Others offer a fixed rate over a set number of years, although you should expect a penalty if you make an early withdrawal.

Opening up a Cash ISA is like opening any other savings account. You just need to be over 16, and a UK resident with a National Insurance number. It’s this simplicity, perhaps, that has made them so popular over the years.

Understand the tax benefits of Cash ISAs

Interest earned in an ISA is tax-free and does not need to be declared to the tax man, which may simplify administration. This is starting to become more of a benefit again, now that interest rates are increasing.

For easy access Cash ISAs, you might expect an interest rate of around 3.25% in April 2023. The best fixed rates are around 4.3% for a 12 month deal and 4.5% for a 5 year deal.

If you maximise your ISA contributions every year, you can start to build up meaningful interest payments, but even so, the personal savings allowance introduced in April 2016 ensures most people will not pay tax anyway.

Outside of ISAs, basic rate taxpayers can earn £1,000 of interest per year before any tax is due. The allowance drops to £500 for higher rate taxpayers. If you’re an additional rate taxpayer, the allowance is withdrawn and you will be taxed on all interest earned outside of an ISA.

Think of it this way. If you’re a basic rate taxpayer earning 3.25% interest, you would need almost £30,000 in cash savings before you started paying tax on the interest. But for high rate taxpayers, you would only need £15,385 before earning enough interest to start paying tax.

Remember, if you don’t use your ISA allowances now and interest rates continue to rise, you can’t backdate contributions. So it’s better to make use of ISA allowances than not to use them at all.

The beauty of Cash ISAs are they are straight forward and easy to understand. Your savings are protected by the Financial Services Compensation Scheme up to £85,000 per bank.

You can check if your savings are protected here.

Consider the drawbacks of Cash ISAs

There can sometimes be restrictions on withdrawals, usually with fixed rate ISAs. Some might consider the annual allowance of £20,000 to be a drawback, although it’s a generous enough allowance for most.

Other than that, the main drawback is the lack of long-term growth potential. Any bank or building society deposit will struggle to grow in line with inflation over the long term. This means the spending power of your money can erode over time.

For example, if you have £10,000 in a Cash ISA earning 3.25% interest, you will earn £325 after a year.

But the Consumer Price Index measure of inflation is 9.2% in March 2023. This suggests that after a year, your £10,000 plus £325 of interest will only buy around £9,400 worth of goods and services. You gain £325 in simple terms, yet lose about £600 in real terms.

Let’s hope that inflation starts to fall back pretty soon!

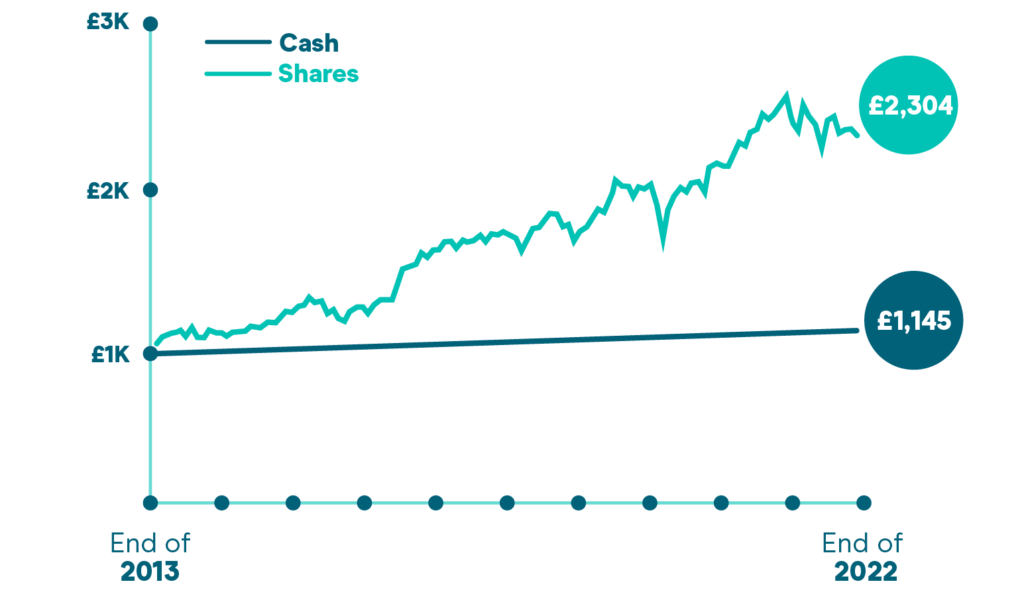

The graph below, from Moneybox, helps illustrate the lack of growth potential with Cash ISAs, compared with stocks and shares. You may be attracted to the smooth line, with no fluctuations in value. But as the example above shows, you’re just exchanging volatility risk for inflation risk.

Cash ISAs remain effective as an ‘emergency fund’, to ensure you have money easily accessible. But generally, they’re not a good option for long term investment of more than, say, 5 years.

Check the rules and allowances

For the 2023 / 2024 tax year, the annual ISA allowance remains at £20,000 per person. This includes contributions to all types of ISA. See the graphic below for a summary of all the ISA allowances.

ISAs cannot be held in joint names. In addition, you cannot open one on behalf on someone else (except a Junior ISA) and they cannot be held in trust.

You can only pay into one ISA type each tax year, so you can’t pay into 2 different cash ISAs in the same tax year.

Cash ISAs are available to those aged 16+, so if you want one for kids, you’ll need to open a Junior ISA instead. On that point, Junior ISAs can be held in cash, but also in stocks and shares. The same principles around interest rates and inflation apply, so think carefully when investing on behalf of children.

Are Cash ISAs worth it?

For non and basic rate taxpayers, the benefits of Cash ISAs look limited at the moment due to low-ish interest rates and the existence of the personal savings allowance. But that’s not a reason to disregard ISAs altogether. Valuable benefits are available from the other types of ISAs.

For example, Lifetime ISAs offer valuable bonuses towards a first house purchase, or to help with retirement planning.

Don’t forget about the benefits of forward planning. The more you can get into ISAs now, regardless of the type, the more tax could potentially be saved in the future. Interest rates may continue to rise and the personal savings allowance could well be reversed by future governments.

If you do feel that Cash ISAs remain a good option, it’s best shop around on some comparison websites, such as money.co.uk or moneysupermarket.com.

Summary

Cash ISAs are straight forward and they can help build up a pot of cash that’s protected from the tax man. Try to make use of your ISA allowance if you have spare money available, but don’t assume that cash is the best option for you.

As shown in the graph at the top, Cash ISAs remain the most popular. But they have a purpose and it’s not to grow wealth over the long term.

Production

Production