Do you believe in fate, or is your path in life determined by your own choices and actions? Wherever you sit on this spectrum of belief, taking some time to design your future can help you make better choices when it comes to money.

This goes beyond financial planning. It’s a concept that’s bigger than working out how to pay for the stuff you want to buy and the things you want to do.

It’s about reflecting on what’s truly important to you. It’s the luxury of creating a plan to live in tune with your values and make the most of your time and money whilst on this Earth – and beyond.

Here are five ideas to help design your future. They might not always be easy to do, but they are achievable and well worth the effort.

1. Identify your values

It’s not easy to articulate your core values. Can you state your top 5 or 10 values?

Working out what’s deeply important to you can take several attempts. And it’s not uncommon to reflect on your answers for several days, weeks, even years. If you look at a list of suggested values, you will probably identify with most of them. So it’s hard to prioritise them down to a core set of just 5 or even 10.

There are plenty of online questionnaires, card games and other resources available to help with this. One option, at $19.95, is the core values assessment at the Barrett Values Centre. It only takes a few minutes, yet provides a surprisingly detailed summary of what your values mean for you.

Coaching provides an opportunity to articulate what’s important to you in a safe, non-judgemental way. Many people find the process of verbalising their values to be deeply profound, particularly when your coach is able to reflect back what you missed yourself.

One key advantage to having clarity of your values is that it helps with decision making. That’s a huge benefit when it comes to planning how best to use your time and money.

Businesses often create a list of core values and these can provide a reference point for decision making. GroWiser Financial Coaching has published 5 core values, which drive the way I do business:

- Growth

- Integrity

- Community

- Freedom

- Wisdom

You can read more about what these values mean here.

2. Assess your strengths

It’s easy to underestimate your skills and talents. As a result, too many people live their lives based upon the expectations of others, to the detriment of their own passions.

By now, you may have noticed this article isn’t really about money. There is a connection, though. If you can imagine a blend of life coaching and financial planning, the result is an immersive and often exciting experience. Financial professionals who work along these lines sometimes describe themselves as financial life planners.

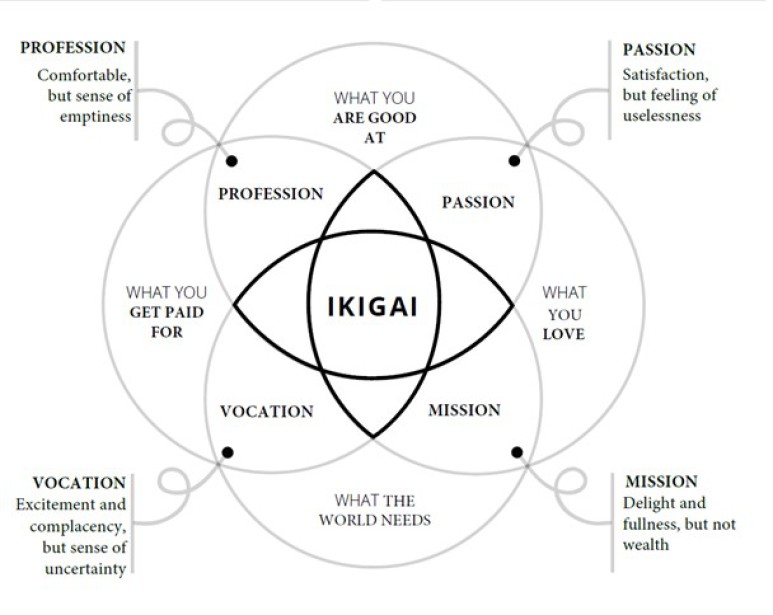

If you can identify:

- What you are good at

- What you love

- What the world needs

- What you get paid for

……then your financial future become much easier to plan. These 4 elements combine to create Ikigai, the Japanese concept of finding purpose for a long and happy life.

So far, so good. But how do you know what your strengths are? Most people can reel off a list of things they’re not good at, but how well can you articulate your strengths?

As always, help is available. If you fancy getting into this in some depth, you could invest £25 in the Clifton Strengths Finder assessment. This will take you through a series of questions, then provide you with a personalised report on your top 5 strengths.

3. Imagine your best future

“I can’t decide what I want for my lunch tomorrow, never mind planning out my life”.

I hear this a lot. We get so caught up in the day-to-day challenges of life, that little energy is left for planning out the longer term. It’s almost as if we can’t allow ourselves permission to dream about the future because it doesn’t feel productive.

That’s partly true, because a dream without a plan of action is just a wish. But if you don’t plan your own future and takes steps to achieve it, someone else will. You could end up feeling under the control of your employer, your partner, family members and others.

Give yourself permission to daydream. Ponder what might bring you the greatest sense of joy in life. Think about how you can use your strengths to achieve great things that align with your values.

Visualising the future can take a bit of practice, but there are loads of tools to help. One idea is to try drawing a picture. It really doesn’t matter how good or bad you are at art. This is for you alone and the value really lies in the process as you bring your thoughts to life.

TEDx speaker Patti Dobrowolski has inspired millions of people to visualise their future through drawings. Some find this exercise easier than others, but it’s no exaggeration to say this has helped to transform lives. It can bring clarity, hope and a renewed sense of purpose.

You can watch Patti’s 10 minute presentation here.

4. Consider your legacy

Even when you have a plan to live your best life, there is another stage to think about.

Abraham Maslow’s Hierarchy of Needs is well known, but few people are successful in achieving the top of the pyramid – Self Actualisation. Maybe it’s because we don’t think big enough. Maybe we need to look beyond our own, individual success and happiness.

What’s less well known about Maslow, is that in the final years of his life, he added another level to the top of his hierarchy: self-transcendence.

This is when we embrace the idea of serving a higher purpose, something bigger than ourselves. It recognises the importance of leaving a legacy. Not just a financial gift to those we leave behind, but what we want to be remembered for.

One way of doing this, morbid as it sounds, is to write your own obituary. Or more precisely, write how you would like your obituary to sound. Completing an exercise like this will help you recognise if your current lifestyle is shaping up in the way you’d like to be remembered.

Initial thoughts about leaving a legacy are often financial. Many parents are keen to pass down assets and wealth and this monetary perspective often focusses the mind on solutions like inheritance tax planning.

But do you really want your obituary to be about the money you left behind, or the impact you had?

Like anything in life, there will be a balance to strike. Your perfect legacy might be a mix of money, knowledge, values and love. But don’t leave it too late to consider how you’d like to be remembered.

5. Build your plan

As mentioned earlier, a dream without a plan of action is just a wish.

This is where financial planning and life planning come together. When you have clarity of what you’d like to achieve and by when, numbers can be added. Then it just comes down to arithmetic to generate the financial actions required to support your desired future.

Of course, the idea that it “just comes down to arithmetic” may not be as easy as it sounds. This part can be a major block for many. If you hold a belief that your ideal life is not affordable, then you will probably take no action.

And if you take no action, of course, your future will not turn out as you dreamed.

Creating a financial plan that’s built around your imagined best future lets you see whether or not you have a shortfall. And if there is a shortfall, you can at least explore options. For example:

- Invest more of your income to help bridge the gap

- Delay future plans to allow more time to accumulate wealth

- Explore less expensive options that still bring joy

Good financial planners and some financial coaches may use sophisticated cashflow modelling software to help with this. But recently, simple cashflow tools have started to become available, direct to the public.

Three options worth looking at are:

If you don’t feel able to create your own financial plan, think about investing some time and money with a financial planner or coach. It could be the catalyst for a turning point in your life.

Summary

“Design Your Future” is the 5th and final step of the ‘SPEND’ programme at GroWiser Financial Coaching. It’s designed to help individuals and couples, especially in their 40s and 50s, gain control of their finances and life plan.

Financial life planning can bring inspiration, excitement and peace of mind into your life. The opportunity to design your future should be available to everyone who wants it.

Take it step by step at your own pace, but the earlier you begin, the more opportunities you will be able to create.

For more details on how financial coaching and life planning can empower you towards your favourite future, book a fee initial chat.

Production

Production