When my eldest son, Adam, turned 18 last weekend, he completed two important tasks. He bought me a drink in the pub for the first time and he took over the management of his personal pension. A small, slightly unusual birthday present for his 1st birthday just turned into financial education that could shape his future.

I opened a Junior SIPP (Self Invested Personal Pension) for Adam on his first birthday and paid in small monthly amounts ever since. Starting at just £10 a month, rising to £32 per month over the past 3 years.

People had a bit of a laugh at the time. It definitely falls into the more unusual category of birthday presents for 1-year-olds. It’s pretty boring, really. He obviously knew nothing about it at the time and I just kept going with quiet, consistent payments every single month for 17 years.

Here’s why I’m sharing this story. It’s not about the actual pounds and pence, because the number are fairly low. It’s about the learning. Numbers from real life experiences teach better than a theoretical lecture. At the age of 18, Adam has seen investment volatility and compounding in action, with his own money.

He’s also taken over his Junior Stocks & Shares ISA, which was originally a Child Trust Fund, and in the last few years, he’s even made some investment choices of his own.

He’s experienced the slow years, the wobbly bits, and the recent bull-run. And now he’s motivated in a way that no book on investing could have achieved.

Let’s take a look at the actual numbers. This case study focuses only on Adam’s pension, not the ISA.

The key numbers

- My money paid in (net): £4,286

- Tax relief added: £1,072

- Total invested (gross): £5,358

- Value on 18th birthday: £9,339

- Total growth so far: £3,982

On their own, these numbers don’t look very exciting. £3,982 in profits over 17 years: so what?

With a little help from ChatGPT and compound interest calculators, the time-weighted return works out at roughly 7.9% a year. This measure strips out the volatility and timing of contributions to give the average investment performance over time.

7.9% isn’t bad, although we could have done better, if I had been more focussed on low-cost equity funds from the outset.

Smart financial education

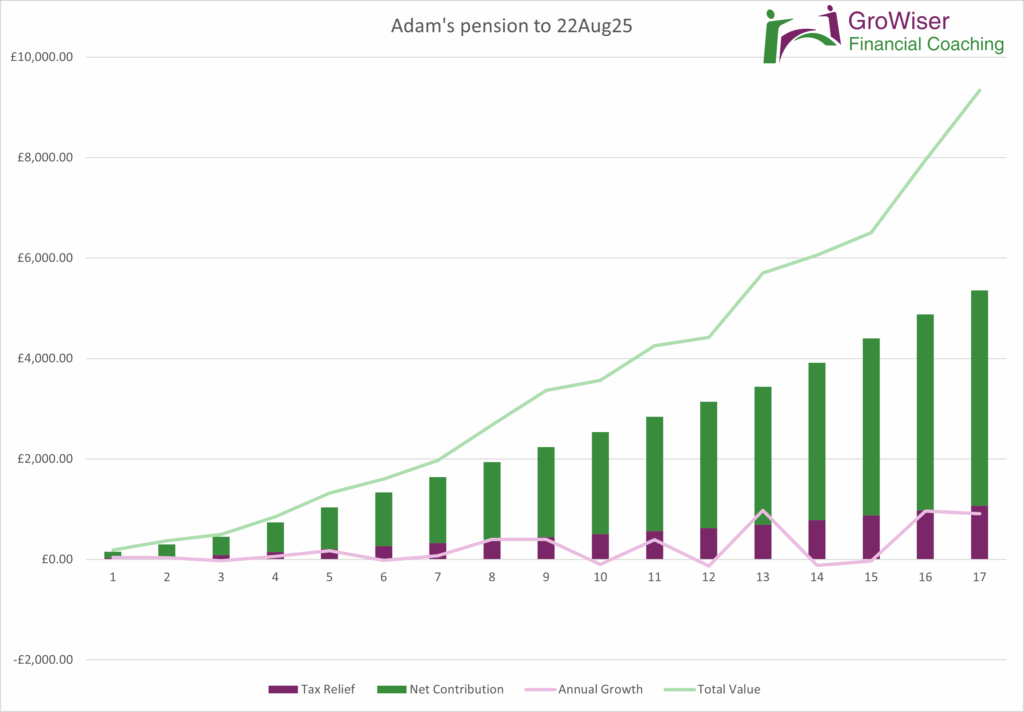

The real lesson, though, is seeing compounding kick in. Growth was slow and sometimes negative in the early years and the graph below shows how total contributions grew steadily over the years. The bars shows tax relief in purple and my net contributions in green.

The jaggy pink line shows the annual investment performance, with some years dipping below zero with negative growth.

The green line is the most interesting bit. It reflects the total fund value, which in the first 7 years, wasn’t much more than total contributions. Compounding is slow to begin with.

It took until year 9 for the annual investment growth to exceed contributions for that year. But from age 10 onwards, Adam’s pension really started to work. The last couple of years, in particular, have shown the benefits of consistent investing when the markets are in a bull run.

Learning to “ignore the noise” of attention-grabbing headlines when things go south is a key element of financial education. The media loves to report bad news and stock market crashes can really test your commitment to staying invested when everyone seems to be panicking.

Adam understands that the value will fall again, and there’s every chance it’ll take a real plummet at some point. But with 17 years’ of hindsight, he knows that despite the ups and down, the trajectory is curving upwards.

On his birthday weekend we had the handover chat: “this is yours now”. Not just the SIPP, but the Junior ISA too (now an adult Stocks & Shares ISA). We completed the admin tasks to switch investments over to his name, and summarised 3 important learning points:

- Keep costs low

- Automate contributions

- Ignore the noise

Since then, he’s been asking his part-time employers when he can join the workplace pension. That’s the win. Using a real case study to build behaviours is far more powerful than giving an 18-year-old a big wad of cash to spend.

The penny-drop moment

Seeing the impact of compound growth piqued Adam’s curiosity. What could happen over the next 18 years – and longer?

Some good old playing around on Excel allowed us to model future growth potential. We wondered what might happen if the 7.9% growth rate continued right up to Adam’s 60th birthday.

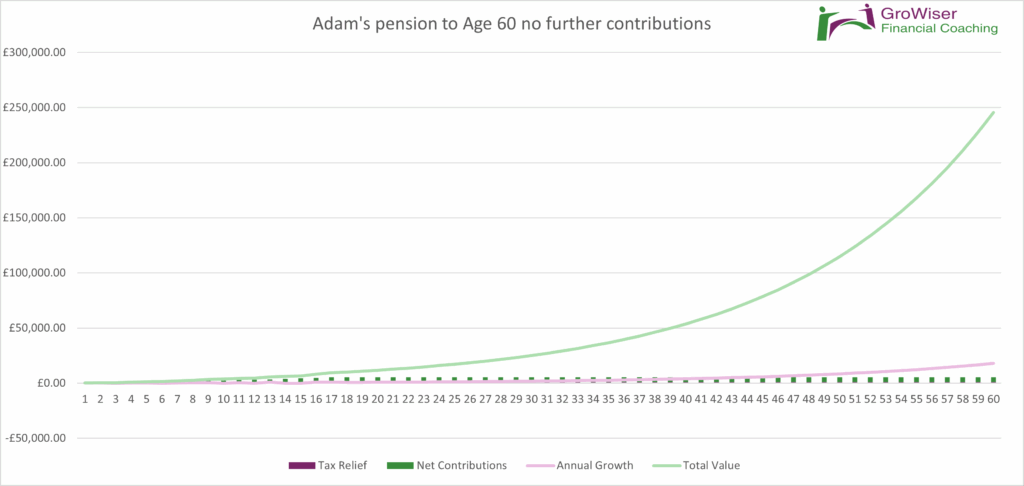

The graph below shows that, even making no further contributions, the fund could grow to almost quarter of a million. Over such a long period, the wobbly line over the first 17 years is virtually invisible and the growth becomes exponential.

So those 17 years of paying a total of £4,286 into Adam’s pension could be quite a tidy sum when he’s 60. Inflation will eat away at the value, of course, but even reducing the growth rate to 5.4% to allow for a 2.5% annual increase in the cost of living, the model would show a fund value of £89,633 in today’s money.

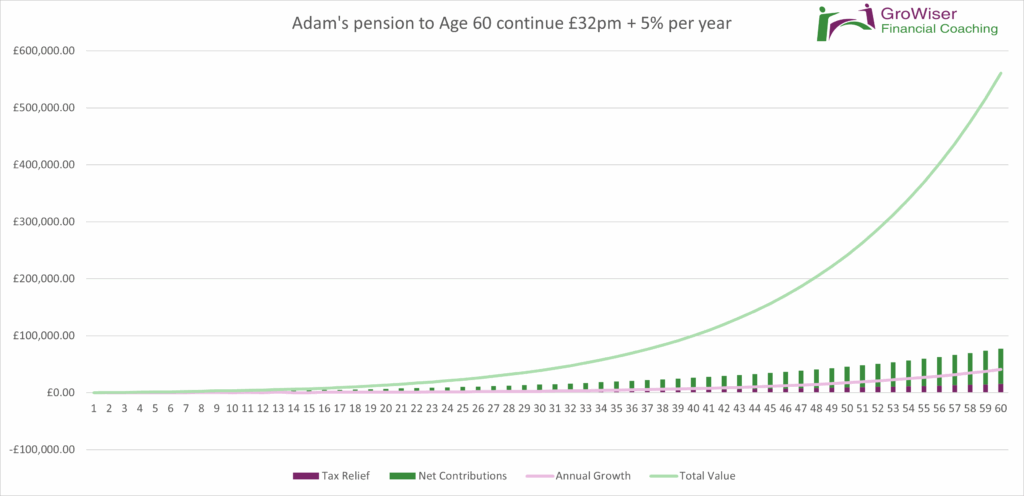

Now, what happens if Adam continues to pay in £32 per month and increases his contribution rate by 5% every year?

Well, that shows a total fund value of £561,014 at age 60, or £272,027 if the growth rate is reduced to 5.4% to allow for inflation.

Not bad for very modest, monthly contributions. It just shows the power of getting started early. It makes you wonder why this type of thing isn’t taught in school, or even the workplace.

The key nuggets of financial education

So what are the key nuggets of financial education that Adam took from our talk on his 18th birthday weekend?

- Use tax efficient pension and ISA allowances, keep fees low and diversify your investments

- Automate a modest monthly amount, which you will soon barely even notice

- Nudge up the contribution a little with every pay rise

- Learn the basics of tax relief (every £80 paid in becomes £100 in the pot for a basic-rate taxpayer)

- Talk about money openly, including wins and wobbles

If you don’t meet auto-enrolment thresholds for a pension at work yet, ask HR if you can opt in. Many employers will contribute too, meaning free money for future you.

As a financial coach, I don’t sell or recommend products, but I do help individuals and couples to build confidence and habits. Getting to know your numbers can help money feel less scary.

I hope Adam’s pension experience helps to show that. Small, steady actions + time = a future you can look forward to with confidence.

Production

Production