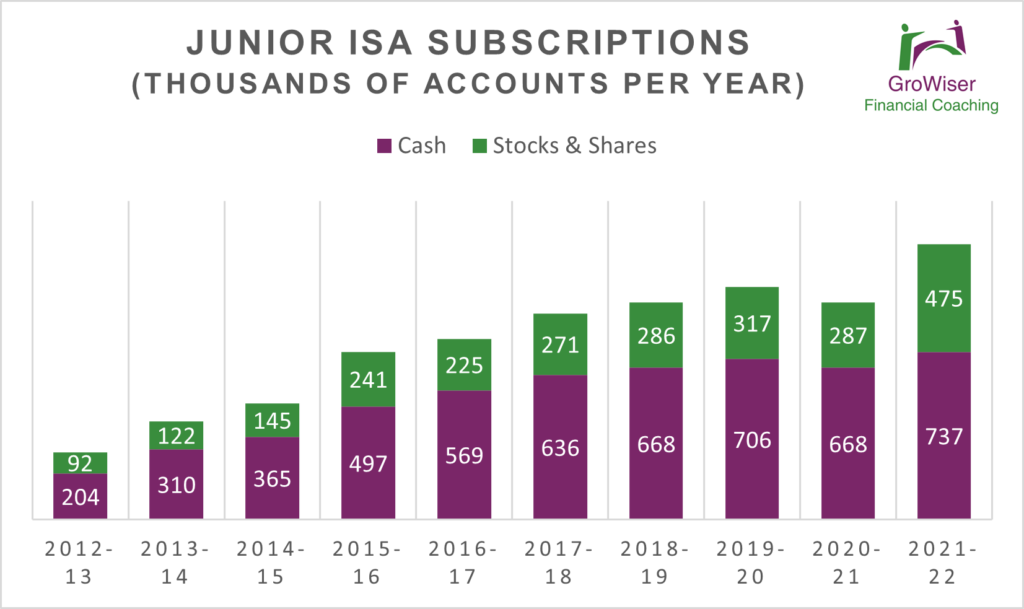

Junior ISAs are becoming more popular each year, except for a Covid blip in 2020, when contributions understandably dropped. This is great to see, but it’s still a minority of parents that make use of the allowance. Much as we all love our kids, giving away our hard earned cash for them to enjoy when they hit age 18 might not feel like a top priority.

It’s worth trying to step back from the day to day challenges of budgeting for a minute. The long term advantages of investing in Junior ISAs can be pretty amazing – and not just in a financial way. Here are five things to consider:

1. Investment choices

Junior ISAs can invest into both cash and investment funds. You can choose what’s best for your circumstances. If you need something accessible and low risk, then a cash Junior ISA is fine. If you need better long-term growth potential, stocks and shares might be better. Although Junior ISAs offer both options, cash remains the most popular choice. A lot of parents and grandparents go for this option because it’s lower risk and easier to understand.

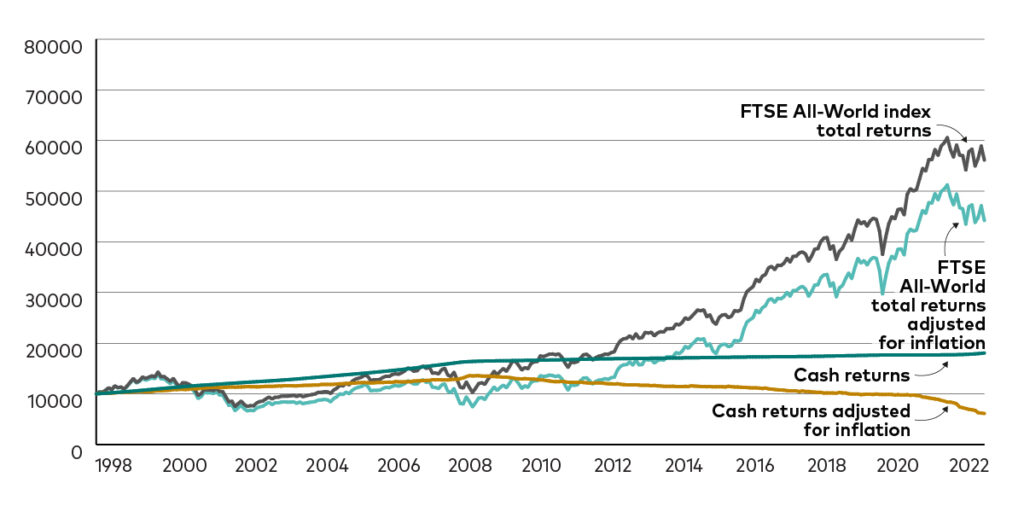

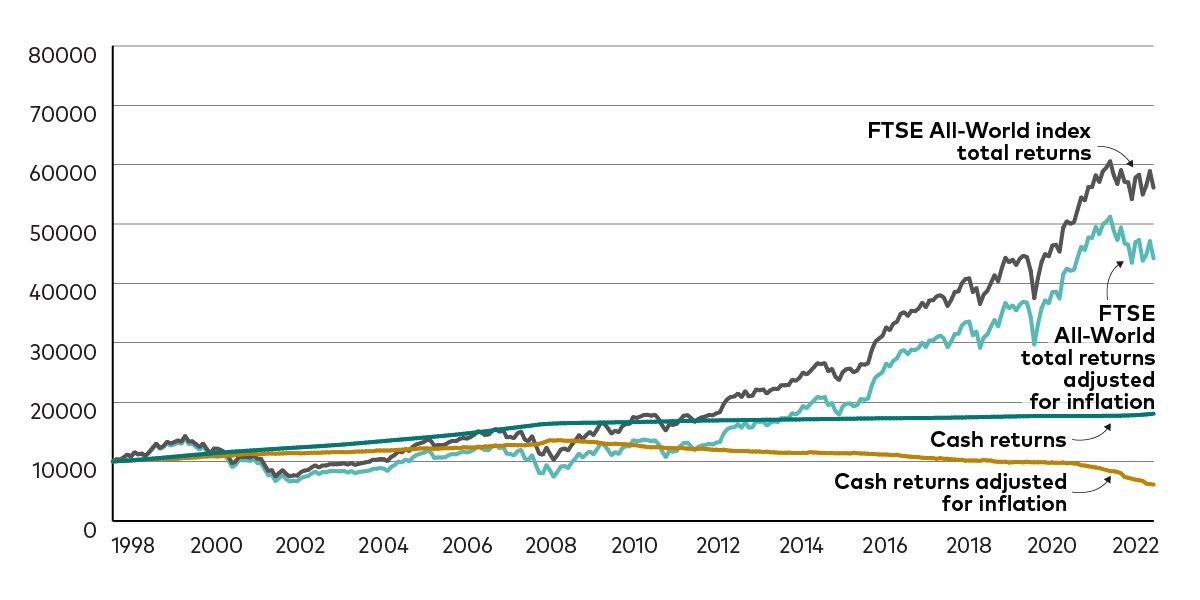

But if you’re putting money away for younger children, it could be many years before they have access to the funds at age 18. That’s where stocks and shares can make more sense. See my article about the benefits of stocks and shares ISAs compared to cash ISAs. The graph below from investment provider Vanguard gives an idea of how the growth of £10,000 in cash has compared with the growth of worldwide shares over a 24 year period.

Returns from £10,000 in cash and shares, before and after the effects of inflation

2. No Income Tax or Capital Gains Tax

All ISAs help to keep your money away from the tax man. This is especially attractive when investing into stocks and shares over the long term. There are no worries about income tax or capital gains tax with an ISA.

Investment gains outside of an ISA can be subject to capital gains tax of up to 20% and income tax up to 45%. If you can, it’s best to keep things simple by maximising ISA allowances. This way, your child will have no need to declare profits to HMRC when they withdraw money in the future. Remember, Junior ISAs automatically transfer to an adult ISA at age 18.

Of course, you might even be able to persuade your grown-up offspring to keep their investment running for the longer term. Think house deposits, university costs and all the other expenses that crop up later into adulthood.

3. Potentially reduce Inheritance Tax

ISAs themselves are not exempt from inheritance tax. When you die, any money you have in an ISA will form part of your estate. That could potentially lead to tax of 40% on assets above the available nil rate band. (£325,000 per person plus an additional residence nil rate band of £175,000 per person in certain circumstances).

The point here, is that if you pay money into a Junior ISA in your child’s or grandchild’s name, that money is no longer yours. So the concept of gifting during your lifetime can help reduce the value of your estate. Junior ISAs could be a simple way to put money in trust for children until they reach age 18.

4. Long Term Growth Potential

A Junior ISA could be in force for 18 years before any withdrawals are made, if opened upon the birth of a child. That’s a long time to benefit from stock market growth, even if it does mean ups and downs along the way. Too many people make the mistake of being overly cautious with childrens’ savings. Cash can languish for years in low interest bank accounts.

In that respect, Junior ISAs are no different to adult ISAs. Always consider the purpose of the money being invested. Unless it’s for emergencies or planned spending in the next 5 years or so, you really should look at other options. It’s important to seek the potential for real growth, over and above the rate of inflation.

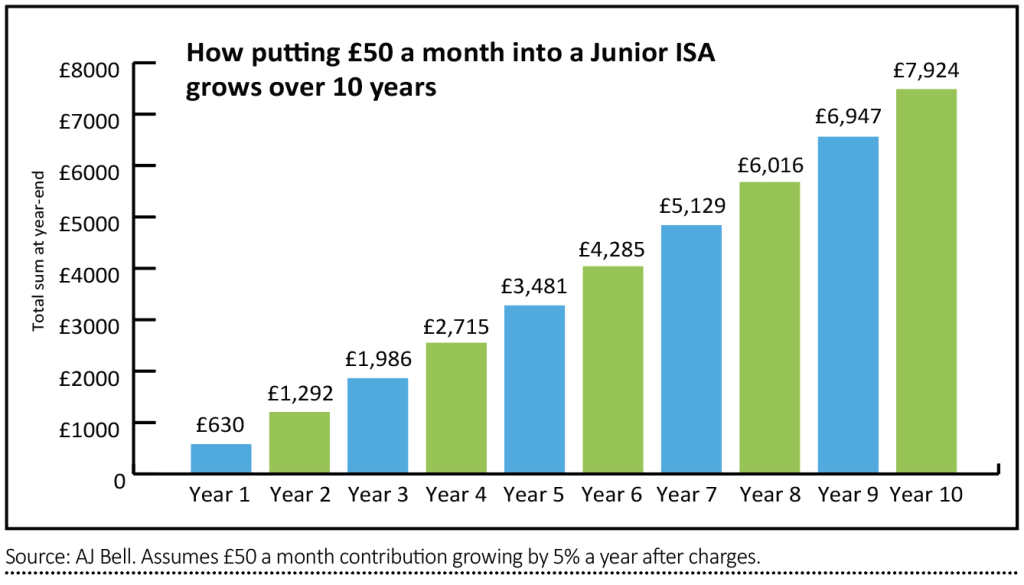

This image from investment platform AJ Bell shows how much £50 per month could grow over 10 years at a reasonable 5% rate of growth in a Junior stocks and shares ISA.

5. Financial Education

Talking about finance with your kids is one of the best ways for them to learn. And chances are they might pay a bit more attention if you’re talking about money that belongs to them. Even if they’re not able to spend it yet!

Logging in and looking at their balance or even just reviewing their annual statement can help build financial literacy. This could be especially valuable for building resilience with investing. If children and young people can see their investment fluctuate in value, they will be better able to cope when they’re older. It can be an emotional rollercoaster seeing the value of pensions and investments move up and down throughout working life.

Summary

So whilst you might not feel inclined to start saving and investing on behalf of the kids, choosing not to could be something you regret later.

Why not scroll down to arrange a chat about how financial coaching could help all the family?

Production

Production