I frequently have discussions with individuals and couples who have a vague sense that they should be investing for the future, but just don’t know where to begin.

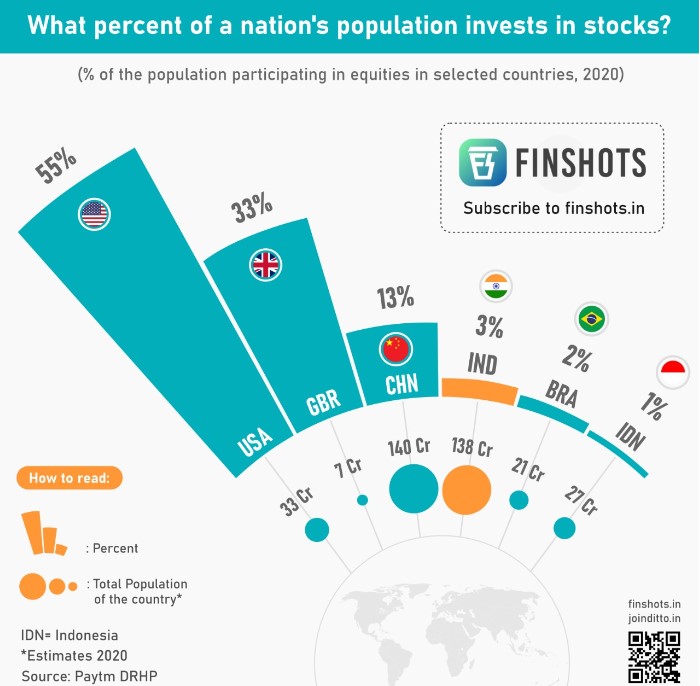

Depending on which research you look at, only around 1 in 3 UK residents are investing into the stock market. It’s a good bit higher in the U.S. and other countries are starting to catch up.

There’s still some way to go in building financial literacy and confidence. Reasons for not getting started include fear of making a mistake, sheer overwhelm at the amount of choice or just plain old procrastination.

So let’s keep things simple and work through 5 easy steps to help make your first investment.

1. Adopt the right mindset

First of all, it’s worth dispelling a few myths about investing:

- You don’t need to be wealthy to begin

- You don’t need loads of spare cash every month

- You don’t need to be a whiz at maths or finance

- You don’t need to wade through reams of technical jargon

- You don’t need to fill out huge application forms

In fact, it’s easier than ever to begin investing and you can even start from as low as £1.

Building up wealth takes time and patience, though, so don’t expect it to be exciting. You may read headlines about spectacular gains and devastating losses, but you’re best to ignore this clickbait. Ups and downs are part and parcel of investing. It’s perfectly normal, although it might take some getting used to.

For most of us, investing is really about creating a new habit and letting it take care of itself over a long period of time. The sooner you can get started, the better. And adopting the ‘Pay Yourself First’ concept can help.

In general, it’s best to pay off any high interest debt first. Investment returns are unlikely to outweigh the interest you pay on credit cards, for example. And it’s a good idea to build up an emergency fund too. The last thing you want, is to be forced into making an investment withdrawal during a temporary downturn. Make sure you have access to cash for unexpected emergencies to avoid dipping into investments.

Initially, don’t worry too much about choosing exactly the right fund with the very best provider. The main thing is just to get started and create a habit of automated monthly payments. As time goes on, you’ll get more of a feel for it and you can make adjustments as you go.

2. Decide your approach

Done by you

If you feel confident enough, one approach is just to get on with it yourself.

Done by you

Comparison sites are a good place to begin. They let you see the difference in charges, investment choices and customer service ratings. Try Money to the Masses, Which or Boring Money.

Done for you

Traditionally, most people would seek regulated financial advice when investing, especially if the amounts involved are large. The advantage here is that a qualified and regulated individual will take the time to understand your circumstances, goals and investment preferences.

Done for you

You can expect a personal recommendation on specific products, providers and funds. Then usually, the adviser’s firm will be able to set up the investments on your behalf and manage them on an ongoing basis. This will cost money, of course, but it saves you the effort and if your circumstances are complex, it can be well worth the fees. Any advice provided is also covered by the Financial Services Compensation Scheme and the Financial Ombudsman Service.

Done with you

Increasingly, would-be investors are turning to coaching and guidance, but stopping short of “full-blown advice”. This approach is all about empowering you to make your own decisions. It will help you plug any gaps in your own knowledge, avoid mistakes and generally bounce your ideas off an expert. It can also help overcome procrastination through goal setting and accountabilit

There’s a huge range in the scope of services provided by financial coaches, so do take some time for research before choosing who to work with. Remember that coaching is not a regulated activity, so ask about qualifications and experience. Equally important is to make sure you feel a sense of ease, trust and empowerment when working with a coach.

3. Aim for tax efficiency

Most people in the UK are able to invest tax-free. Broadly speaking, if you’re of working age, you could even pay everything you earn into pensions and ISAs. Similar arrangements are available in many other countries.

ISAs (Individual Savings Accounts) are a logical choice, due to their flexibility and range of options. Click here to read more about ISAs, but in short, your money will grow free of capital gains tax and income tax. That means no nasty surprises when it’s time to make a withdrawal.

Don’t discount pensions as an option, particularly if you’re keen to build up money to enjoy in your 60s and beyond. Pensions are super tax-efficient when paying money in, although remember you can’t take money back out again until at least age 55 (increasing to age 57 in 2028).

If you’re considering larger investments beyond the scope of ISAs and pensions, there are other tax-efficient options. It starts to get complicated, though, and often the risks are higher. So best to seek advice in those cases.

4. Develop an understanding of risk

The idea of your money being at risk may sound a bit nerve-wracking. Some people have been caught out with high risk investments and scams and in these cases, it can even be possible to lose all your money.

Don’t go there. Stick to well established investment providers that are regulated and covered by the Financial Services Compensation Scheme (if you’re in the UK). Also, ensure your money is well diversified through the use of mutual funds and low costs index trackers.

For most people, “risk” really means volatility. That’s the extent to which the value of your investments will move up and down. It can feel unsettling to begin with, but you need to focus on the long term and accept that downward movements are inevitable. Sometimes, pretty drastic downwards movements and sometimes, pretty impressive upward movements.

Different investment funds will have different levels of volatility ranging from more conservative to aggressive. This allows you to choose an option that you feel more comfortable with, but also one that fits in with your goals and circumstances. Generally speaking, the longer you have available to invest, the more volatility you could accept – if you can stomach the emotions! For an indication of your own tolerance for risk, try this free risk appetite questionnaire.

5. Make your first investment

Finally, there comes a time when you need to make a decision. You’ll need to choose which platform (provider) to go with and which investments funds to buy.

If your approach is to seek regulated advice, this bit will be done for you. If you choose a “done with you” approach, your coach or guide will help you understand the options available, but you’ll still need to make the final choice.

Start by choosing your provider, or platform. Influences here will be the fees payable, range of investment options available and perhaps the ease of use and customer service levels.

Once you’ve decided which investment provider to go with, you’ll need to choose funds. Depending on the platform you choose, you might get help with this. For example, Wealthify, Vanguard, Moneybox and Moneyfarm are examples of apps that will guide you into a managed portfolio, in line with your appetite for risk.

Some of the key decisions you might make when investing include:

Passive v Active:

Passive funds simply track a stock market index like the FTSE100 or S&P500. They tend to be low cost and aim to produce steadily average returns. Active funds have a team of analysts, who attempt to out-perform the general stock market by making good investment decisions. These funds are more expensive, but research shows that very few of them actually succeed in out-performing passive funds over the long term.

Investment preferences:

When investing into funds, your money will be spread across many different businesses. To a large extent, you can choose the type of businesses you want to support. For example, most providers now offer the option of environmental and socially conscious funds.

Volatility:

As mentioned above, you will have a choice of risk levels. Generally, the more risk you accept, the higher potential returns. But that’s also true of the volatility.

Diversification:

There’s a good argument for splitting your money across a range of different asset classes, such as equities (shares), bonds and property. Many providers will offer access to multi-asset funds which will automatically ensure your money is spread across a wide range, and in line with your risk level too.

Summary

This has been a fairly high level walk through to help make your first investment. You’re unlikely to get it perfect to begin with. Even if you work with an adviser, it’s impossible to predict the best investments of the future.

Start small, but build a habit of regular monthly investments and you’ll be on your way. Don’t obsess over it and avoid checking investment valuations too often.

For a more detailed guide, you can download my free brochure 12 key points to consider before your start investing.

And if you’d like to discuss whether the “done with you” option could be right for you, why not book a free, 30 minute initial chat? It could be your first step towards financial independence.

Production

Production