In today’s fast-paced world, the ability to map your money goals is more important than ever. Few workers can rely on defined benefit or ‘final salary’ pensions these days and increasingly, we must plan for our own retirement income.

To add another layer of complexity, the traditional concept of retirement is fast disappearing. It’s now more likely that people will work for longer, but perhaps committing to less hours, or switching across to a more satisfying job that pays less. Mini-retirements and sabbaticals are becoming more popular and following the ‘Great Resignation’ more people are leaving corporate work to pursue their own business or side hustle.

Goals-based financial planning

These ever-changing and diverse lifestyles make planning for the future more challenging. Goals-based planning is about creating the right financial infrastructure to support your big aspirations in life, whether it’s buying a home, funding education, starting a business, or securing a comfortable retirement.

By aligning your financial resources with your personal goals, you’re placing focus on what truly matters to you. Fortunately, there are some excellent lifetime cashflow modelling tools available to financial planners, who can work with you to create a visual representation of your projected financial future.

In fact, some basic versions are becoming available to the public and these can help build engagement to get you started.

Read on to find out how you can use a free goal-mapping tool to start thinking about your own financial planning.

Free financial health check

Set aside 20 to 30 minutes and work through the 8 screens on this goal-mapper tool to complete a free financial health check. This interactive session will help you reflect on key financial priorities, like your home, retirement, family and loved ones. You can also take stock of where you are with wills, powers of attorney, financial protection and monthly budgeting.

A key feature of the tool allows you to toggle between different standards of living in retirement – “minimum”, “moderate” and “comfortable”. This uses data from the Pension and Lifetime Savings Association as a guide on how much you could expect to spend each year in retirement.

Combined with other “one-off” financial goals, you can start to build a picture of how much money you’ll need in the future.

Your existing pensions

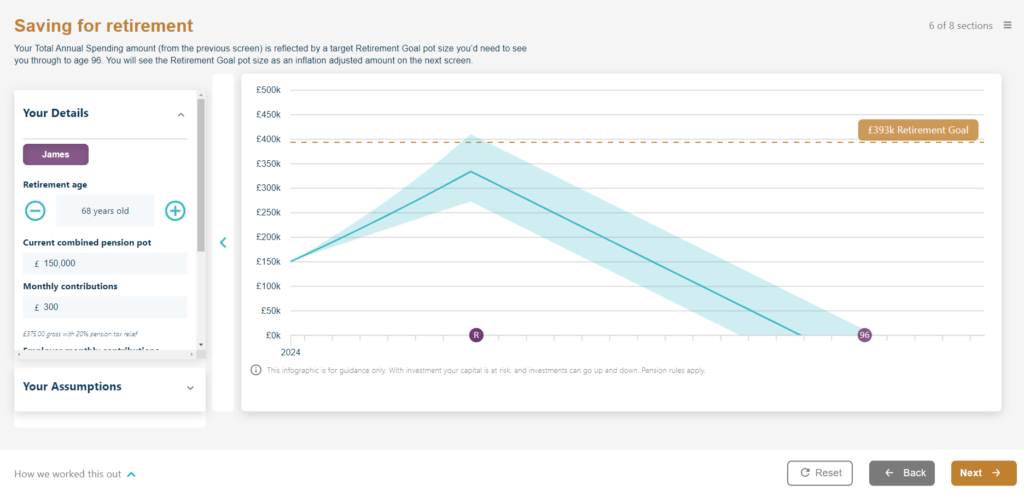

Once you’ve entered your financial goals and desired standard of living for retirement, you can enter the combined value of your existing pensions and ongoing contributions. This allows the goal-mapper tool to calculate a range of outcomes that give an indication of whether your pensions could be building up quickly enough.

In the example above, the graph indicates that James’s retirement goals might be slightly beyond reach. There’s a fair chance that he’ll run out of money before reaching a reasonable life expectancy of age 96.

This could be just the level of awareness that James needs to take action and start looking at his finances more seriously.

Remember, this is a basic introduction to the concept of financial planning and will not provide an accurate outcome. In fact, with lifetime cashflow modelling, it’s simply not possible to predict an accurate outcome. This is because of the sheer number of assumptions that need to be made, the majority of which will not turn out to be true!

It’s often said that the value of financial planning is the process itself – not the outcome. A financial plan will always become out of date almost as soon as it’s created, but the value lies in updating it, tweaking the assumptions and course-correcting along the way.

Some assumptions

A valuable aspect to financial planning that can really help build awareness and understanding, is to ‘play’ around with assumptions. Aside from unexpected life events and higher or lower spending than anticipated, the key financial assumptions include estimates for:

- Inflation

- Interest rates

- Investment returns

- Fees and charges

All of these can have a significant impact on calculations over the long-term and it can be helpful to stress-test your financial plan by changing them.

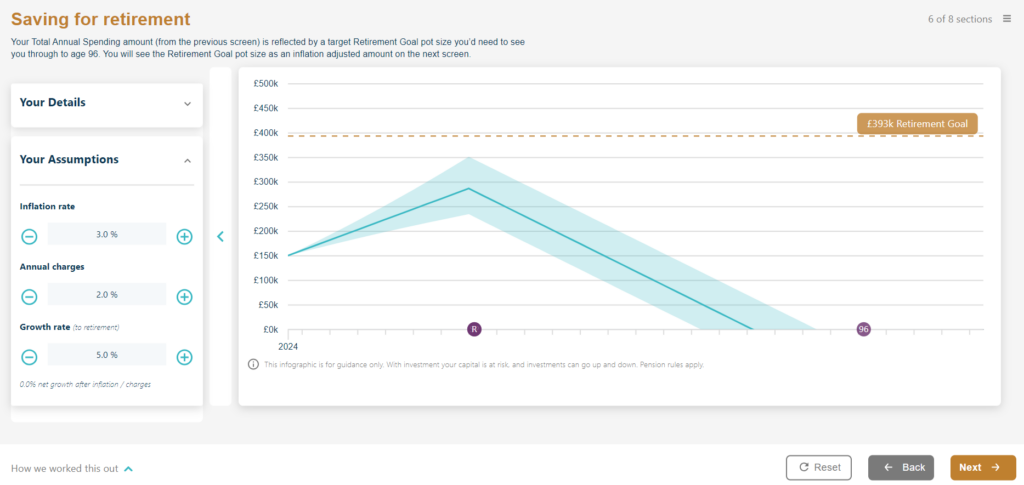

The image below is the same scenario as above, but with the following changes:

- Inflation increased from 2.5% to 3.5%

- Investment growth reduced from 6.0% to 5.0%

The result indicates a more likely shortfall and this is why it’s important to update and monitor your financial plan, at least annually.

For some, having a financial plan will provide an “early warning” signal that action needs to be taken. For others, it may offer re-assurance and “permission” to enjoy life a bit more.

Either way, the process of planning helps you reflect on what’s most important to you in life so that you can make informed decisions about your money. Ultimately, it’s about making the most of your time, whilst being young and fit enough to enjoy it.

Summary

Have a go and map your money goals using the financial health check tool. If you enter your email address at the end, I’ll send you a detailed report with a summary of your goals, together with information to help you become more financially prepared for the future.

And if it whets your appetite for a more detailed and personalised financial plan, do get in touch.

You can find out more about my financial planning packages here and working with me always begins with a no-obligation 30-minute chat over Zoom.

Production

Production