After gradually building up the components of an online financial coaching practice, I finally left the security of full-time employment this week. Here’s a condensed summary of my journey to the fear, freedom and excitement of self-employment.

It’s been a long time coming

After 30 years of working in financial services, I finally gained the confidence and clarity of thought to go it alone.

Back in 1990, it was still seen as a positive step to get a ‘job for life’. That’s when I joined Bank of Scotland, straight from school. Mind you, I only took that job as a temporary money earner, while I worked out what I really wanted to do. 23 years later, I was still there, albeit the company had morphed into Halifax (HBOS) and then Lloyds.

It then took nearly 5 years of contracting and another stint of employment before eventually creating my own financial coaching business.

Three decades ago, I started as a bank junior, before making it to teller, then various other branch-based roles. After working in a few different branches and a 3 month stint in Leicester, I ended up in the lending team. This is where I first started to appreciate the real difficulties that individuals and business could find themselves in.

After 10 years in banking and with a Diploma in Financial Services under my belt, I moved into the world of regulated financial advice. This is when the learning curve became really steep. Little did I know it, but I had 15 years of gruelling study and exams ahead of me.

Knowledge ain’t everything

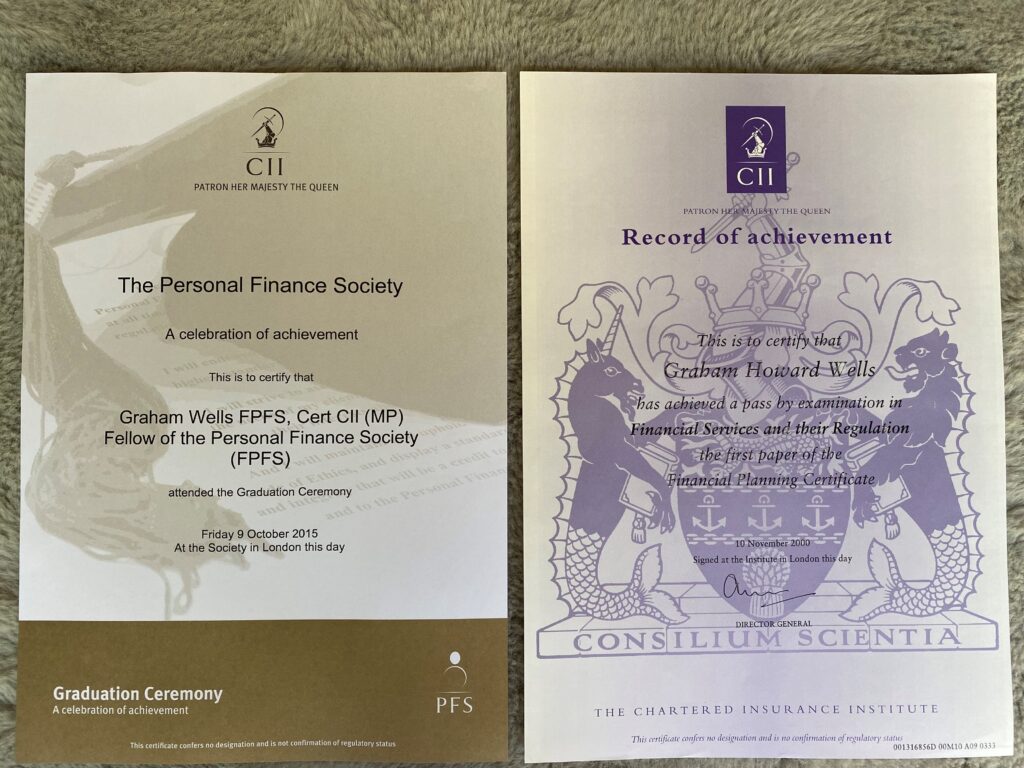

These two certificates show the 15 year gap between my first exam pass and achieving Fellowship of the Personal Finance Society. It included a total of 18 exams, so I had built up a lot of technical knowledge over that time.

But guess what? Most of that learning is not needed on a day-to-day basis. Looking back, I learned a lot more from other people by developing my skills as a trainer, supervisor and coach.

I now realise that reaching Chartered Financial Planner status was just the beginning. Much more impactful, has been learning about the behavioural side of finance.

Technical knowledge is important, of course, but it’s not everything. It is actions that count towards success and when it comes to personal finance and wellbeing, it’s too easy to fall into inaction.

I never was 100% comfortable with the concept of advice, even when I was a regulated financial adviser. I suppose I’m not that keen on receiving advice myself. Instead, I like the feeling of empowerment to make my own decisions without being influenced by the opinions of others. That’s when I realised that coaching can be so incredibly powerful.

The power of coaching

My first real experience of coaching was in Lloyds Banking Group, when I was supervising and helping to develop other financial advisers.

This is when I first worked with a manager who instilled a culture of development through coaching, rather than telling people what to do. It was pretty revolutionary for me. Although looking back now, I realise that I was just scratching the surface at the time. But it was enough to make me start pondering. I wondered if a hybrid of financial advice and coaching might be more engaging and empowering for clients.

In 2014, the opportunity for voluntary redundancy came along. That was my chance to dedicate more time to this fledgling idea. So I managed to find one other person who did this at the time – Simonne Gnessen of Wise Monkey Financial Coaching, based in Brighton.

I travelled down there for a week’s worth of financial coach practitioner training, condensed into 3 intensive days. It was eye-opening, exhausting and inspirational.

I came home buzzing with the intention to pick up some short term or part time training contracts. I thought this would pay the bills while allowing me to develop the financial coaching idea. It wasn’t to be, though.

I ended up as busy as ever, travelling the UK on training contracts with Santander, Tesco Bank and Standard Life. I had a contracting business, but it wasn’t ‘proper’ self-employment. And after 6 consecutive contract renewals with Standard Life, I accepted a full-time position with the 1825 Financial Planning Academy.

In the past year, as Covid-19 lockdowns hit, I completed a professional coaching qualification with Full Circle Global. Exactly as advertised on the course materials, it was transformational. Besides building coaching skills to help others, I was coached myself as part of the experience.

Spending time with a qualified and experienced coach really does help you become more self-aware. Your personal values and ambitions become clearer. You are afforded a rare opportunity to be listened to without interruption. Challenged without pressure. Encouraged without judgement.

The transition to self-employment

As part of the coaching qualification, my course mates and I were asked to write an affirmation of how we visualised our life six months into the future. In September 2020, I wrote :

“I am Graham Wells, it is March 2021 and I’ve had an amazing year and these are the reasons why:

I have gained a ‘proper’ coaching qualification.

I have created a brand, a website, a business plan and launched GroWiser.

I have created time to achieve my purpose by breaking the ‘full time permanent’ trap.

I have changed the lives of 10 paying clients.”

Well, I’m 3 months behind schedule, but it has all happened! (Even if the ‘changing lives’ part is in a relatively small way for some clients.)

There was a whole load of other stuff to do in the background before leaving the security and structure of employment. I knew that building my first website from scratch would be a challenge, but that was just part of it.

Registering with the Information Commissioners Office, joining the International Coaching Federation, finalising the business structure, insurances, client relationship management system, software providers. The list goes on and on.

But the great thing is, no-one needs to be alone when setting up a business. There’s a great support community out there, all brought closer together with everyone now comfortable using video meetings.

The journey continues

I’m a strong believer in lifelong learning and I continue to develop my knowledge and skills. Next up is the Financial Wellbeing Certificate from the Institute for Financial Wellbeing.

This new qualification will help me focus my service purely on the wellbeing of clients, with no attachment to products, assets under management, commissions or sales targets.

I believe there is a way to truly gain control of your life and your money, without necessarily following personal, regulated advice. I would describe financial coaching as a blend of two key aspects:

- practical money mentoring, drawing on the experience of your coach to get your finances in order and build your own knowledge and resilience.

- true coaching, where you are the expert of your own life and come up with your own solutions. Similar to life coaching, it helps you identify your core values, prioritise what’s important and align your financial decisions with your life aspirations.

So, now that I’ve created my own business, it’s time to build it up and work with more people to improve financial wellbeing. Next item on my learning agenda: marketing!

Summary

Financial coaching may not be for everyone and I know it will take time to build this business into something successful.

For those who want someone else to do all the work, traditional financial advice might be better. Those who are already wealthy, with complex circumstances, might need regulated advice on specific financial products.

In the not-too-distant future, I believe that many people will benefit from working with both a financial coach and an adviser. I look forward to working alongside regulated advisers with shared values to help offer the most comprehensive financial experience for clients.

In the meantime, if you’d like to be in a different place in 6 to 12 months’ time, perhaps you could benefit from coaching too.

I’d be delighted to have a chat with you about it.

Production

Production