There are really only two finite things you can spend in life: time and money. The question is, do you savour your spending of each? And can financial success be achieved by building a higher appreciation of how you use each of these precious resources?

Everyone has a unique financial position, but time is a great leveller. We all start each day with 24 hours and it’s how we choose to use that time that matters. As the saying goes, “time is money”. But that must also mean that money is time. Perhaps time can be bought by choosing to work less and enjoy more of what brings happiness. Or could you invest in health and wellbeing to improve your longevity?

These are tricky questions, but as a starting point, try these five activities to gain more control over your daily finances. That should at least help you assess whether or not you savour your spending of money.

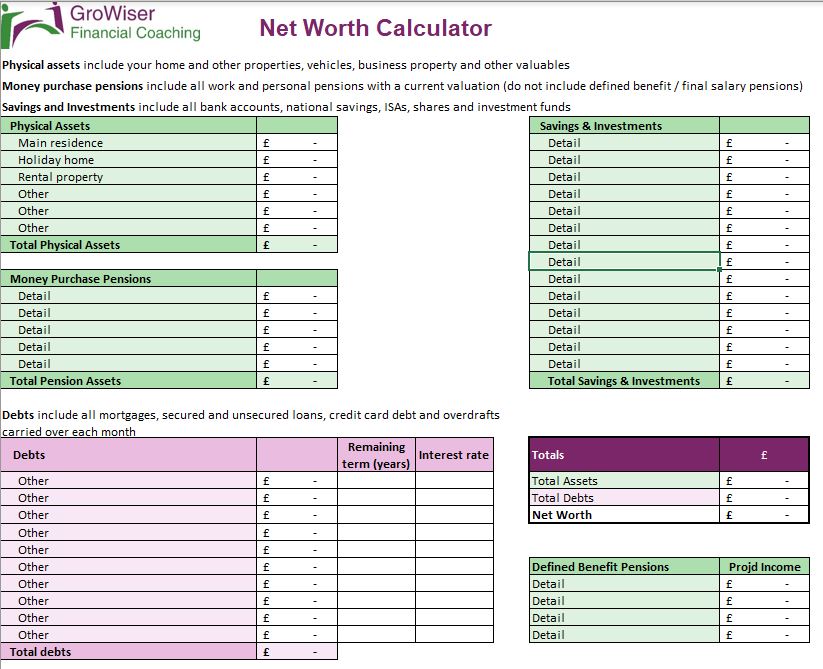

Calculate your net worth

Net worth is not the same is self-worth, so this exercise is not about trying to measure how rich and successful you are. But it sets a starting point, a benchmark, on the journey of financial wellbeing.

One challenge when it comes to financial planning, is knowing how much money you need for the rest of your life. Some people get it wrong. They have far too much money, which runs the risk of dying with plenty of cash, but also plenty of regrets.

Others, of course, don’t yet have enough money to live their best life. So it’s a good starting point to at least know your current position.

Net worth is basically all of your savings, investments, pensions, property and other assets added together. Then you deduct money that you owe, such as mortgages, loans, certain business debts etc.

If you would like a free Excel spreadsheet that can help you with this calculation, visit the ‘Resources’ section of my webiste.

An exercise like this can sometimes bring up opportunities to reflect on the bigger picture. If you have a surprisingly high net worth, perhaps you no longer need to work so hard. Maybe you could savour your time a little more, doing things that you love.

If your net worth is disappointingly low, perhaps it’s time to think of ways to build more wealth. Are you really savouring everything that you spend your money on currently?

Gratitude plays an important role here. Appreciating what you have now, both time and money, creates a good mindset for decisions that are geared towards longer term happiness.

Identify your essential expenses

In my experience, most people tend to lump their spending into one big melting pot. Direct debits, standing orders, cash withdrawals and debit card payments often come out of the same bank account. This can make it difficult to plan and even harder to get a grasp on how much pleasure your purchases provide. In other words, it makes it hard to savour your spending.

A good place to start is to work out how much money you need, as a basic minimum, to survive each month. That means get through the month without going hungry, cold or homeless. Take account of rent or mortgage payments, household bills, insurances, loan repayments, food and essential travel.

You can also include the absolute minimum you’re willing to accept in the way of leisure and social life. That could include some costs towards exercising, TV subscriptions and hobbies that keep you active and stimulated. Think of ‘lockdown spending’. What can you get by on, without much in the way of socialising and holidays?

Pension contributions will usually be paid by your employer before you receive your salary. But if you’re self-employed, include your pension payments here.

Allocate your leisure spending

You can lighten up a bit now and total up your spending on discretionary lifestyle choices. These are things that, theoretically, you could do without, although life would be less fun.

Take account of your regular holidays, weekends away and nights out. Maybe things like electronic gadgets, health and beauty and new clothes that you don’t necessary need to survive.

Allocate your leisure spending

This layer of spending, on top of essential expenses, helps put a number on your current, expected standard of living.

You should now be able to judge your cost of living and whether it’s affordable. If your income is less than your essential and leisure spending, you either need to increase your income or reduce your spending.

If your income is higher than your essential and leisure spending, you have the luxury of creating financial options in life. This can be a trade-off between having fun now, against investing in your future self.

Plan your luxury treats

Now it’s time to set out what you spend on less regular ‘treats’. Start to think about purchases like special holidays, experiences or new cars. It could be home improvement projects, or big electronic purchases or even training courses to build your personal development.

These are spending choices that come along every so often but can really trip you up if you’ve not planned for them. This is stuff that’s not visible on your month-to-month spending and often, it can end up on credit cards or come out of savings.

Savour your spending and plan luxury treats

This level of spending will only feel comfortable if you have a surplus after your essential and leisure spending. Or if you receive unexpected windfalls like bonuses and gifts. It’ll be harder to savour your spending if you know it’s not affordable and likely to accumulate debt.

Set a spending plan and monitor

If you’ve made it this far, you will have a solid grasp of your net worth and your monthly spending, together with bigger, less frequent luxuries. The questions to ask now are:

- Do you need to increase your net worth?

- If not, is it time to think about making more of your time?

- If you do, what scope do you have to increase savings and investments, or to reduce debt? (You might need to your re-visit your leisure and luxury spending plan here.)

That should help you decide if you need to make any changes to how you spend your time and money. Then it’s a case of sticking to the plan – the tricky bit!

Various techniques can be used to help keep you on track and this is where financial coaching really adds value. Spending and savings habits are mostly behavioural and are affected by your specific circumstances, beliefs and relationship with money.

Practical solutions might include:

- Set up a separate bank account for all your bills. This means you only need one payment out of your salary each month, then you can relax. What’s left is your spending money for the month. This can work really well for couples, where you each contribute a fixed amount towards bills.

- Make sure you include any savings and investments as part of your ‘bills’. See my article about Pay Yourself First for more on this.

- Use another separate account to save for your luxuries, rather than paying by credit card and then playing catch-up.

If you don’t fancy having so many separate accounts, it’s worth taking a look at ‘challenger banks’ like Monzo or Starling. They offer easy to use apps and separate ‘pots’ for your money to help with budgeting.

Apps like Moneyhub can also be a great way to track your spending by category. They use Open Banking, so that you can see details of all your bank accounts, investments, pensions and even property, all in one place.

Summary

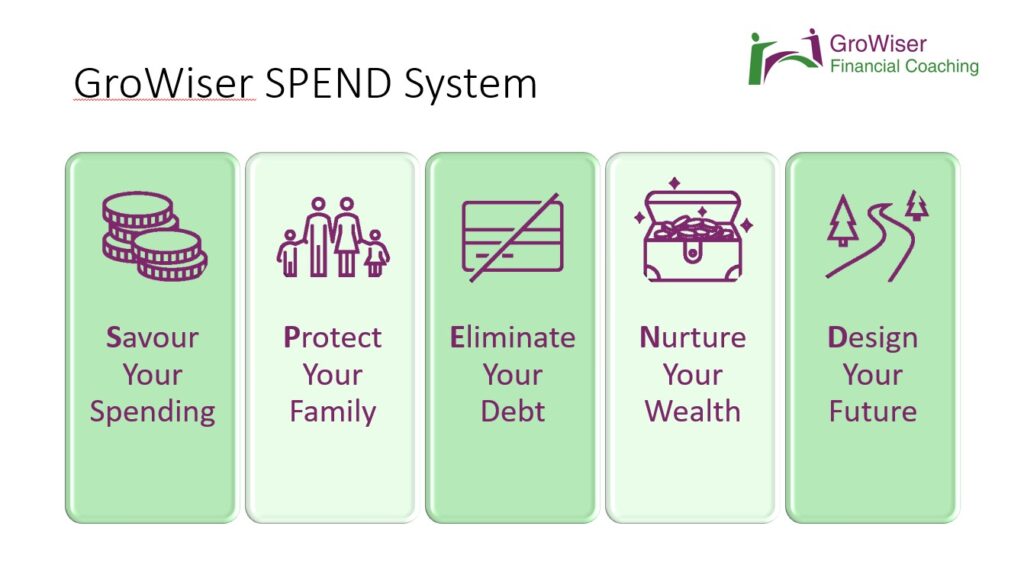

Thinking how best to value your time and your money is all about gaining control and building gratitude. Savour Your Spending is the first stage of the GroWiser Financial Coaching ‘SPEND’ programme.

With this foundation in place, you can then progress your financial wellbeing with the next four stages:

- Protect Your Family

- Eliminate Your Debt

- Nurture Your Wealth

- Design Your Future

Click here for a more detailed overview of the ‘SPEND’ system and if you would like to discuss how financial coaching could help you, book a free initial chat below.

Alternatively, sign up for my weekly newsletter for more thoughts about balancing money and lifestyle.

Production

Production