In last week’s budget, Chancellor of the Exchequer Rachel Reeves announced that the UK’s Personal Allowance and Nil Rate Bands would remain frozen. This decision creates “fiscal drag” for taxpayers, impacting not only income but also wealth and legacy planning.

So let’s take a look at what this freeze means for you and how “stealth tax” quietly affects your financial future.

What is Fiscal Drag?

Fiscal drag is a subtle mechanism that increases government income over time, but without an explicit increase in tax rates. It’s often referred to as “stealth tax” and the effect creeps up on you gradually.

When tax thresholds are frozen, they fail to adjust with inflation. What this means, is the tax-free portion of your income or your estate does not grow in line with the cost of living.

This causes more of your income and assets to fall into higher tax brackets as inflation, pay rises and investment returns boost the value of your income and / or assets.

Essentially, fiscal drag means that you could end up paying more tax even though your actual earnings or assets haven’t increased in real terms.

What Does It Mean for Your Income?

The Personal Allowance in the UK is currently £12,570. This is the amount you can earn before paying any income tax. It’s been at this level since April 2021, even though the rate of inflation has exceeded 10% since then.

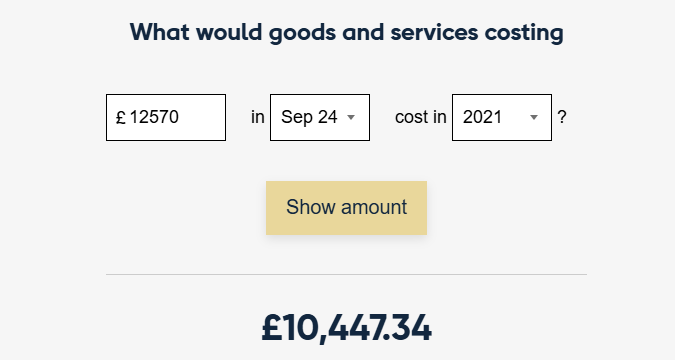

On the Bank of England’s website, you can find a handy little inflation calculator. A quick play with this shows that, in real terms, the Personal Allowance is now worth only £10,447.34 compared to its value in 2021. The cost of living has gone up, but the tax-free proportion of your income has not.

As wages adjust to the cost of living, the freeze on the Personal Allowance means that a greater portion of income is taxed. This effectively reduces take-home pay in real terms.

Over time, the cumulative effect of this “creeping” taxation can be substantial. It particularly affects middle-income earners who may be nudged into a higher rate tax bracket.

The Personal Allowance remains frozen until 2028 so we have another three tax-years’ of gradually increasing taxation…..without the government needing to announce any tax rises.

What’s the Impact on Inheritance Tax?

Fiscal drag doesn’t just impact income. It also affects wealth through Inheritance Tax (IHT). The Nil Rate Band for IHT, currently set at £325,000, has been frozen since April 2009.

Many estates also benefit from the Residence Nil Rate Band (RNRB) which is an additional allowance, also frozen at £175,000. This applies where a family home is being left to direct descendants, including children (biological, adopted, foster, or stepchildren) and grandchildren.

Don’t forget that spouses and civil partners can benefit from the Transferable Nil Rate Band too. This is where any unused NRB from the first to die passes to the survivor. So it’s quite possible that for couples leaving their main property and other assets to family, they’ll have an overall Nil Rate Band of up to £1,000,000.

Under the latest announcements, however, these Nil Rate Bands will continue to be frozen until at least April 2030.

This 21-year freeze of the Nil Rate Band means that some families will need to plan their finances carefully if they want to maximise gifts to the next generation.

As property values and asset prices increase, more estates will breach the Nil Rate Band thresholds, even if they wouldn’t have qualified for IHT a few years ago. Individuals and families are increasingly finding themselves in the IHT net. With an inheritance tax rate of 40% on the excess, it can be quite troubling.

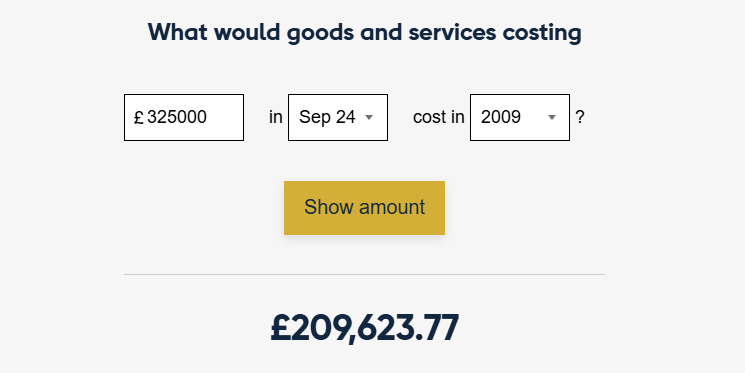

Fiscal drag in the IHT context is, therefore, a quiet but significant way in which the tax burden on inheritance grows over time. Using the same Bank of England inflation calculator, £325,000 of spending power in 2009 was only worth £209,623 by September this year.

It’s worth noting that less than 5% of estates pay inheritance tax at the moment, but clearly, more and more will fall into the ‘trap’ as fiscal drag takes effect.

An Example Calculation

To illustrate the effect of fiscal drag, let’s consider a hypothetical scenario for someone based in England or Wales. (Calculations for residents of Scotland are slightly different).

Imagine a taxpayer, Sarah, who earns £40,000 annually. As it stands she would pay 0% income tax on the first £12,570, then 20% on the next £27,430. This amounts to £5,486.

If Sarah receives a 5% salary increase in line with inflation, this brings her annual income to £42,000.

Without Fiscal Drag:

If the Personal Allowance had increased with inflation, Sarah’s tax-free income might have risen to, say, £13,200. She would then be taxed on £28,800 of her income (£42,000 – £13,200)

With a 20% basic rate of income tax, this would amount to a tax bill of £5,760.

That’s £274 more in tax compared to the previous year, but that’s in line with inflation.

With Fiscal Drag:

Because the allowance is frozen, she’s still only able to earn £12,570 with no tax. This means £29,430 of her income is taxable (£42,000 – £12,570).

With a tax rate of £20%, this results in £5,886 of income tax, an increase of £400 from the previous year.

The difference between the £5,886 bill and the £5,760 bill is £126 and this is the fiscal drag effect. That’s £126 of additional taxation over and above the effects of inflation.

Confusing isn’t it? If I were a cynical thinker, I might wonder if the government relies on this confusion to make it seem as though they haven’t raised tax. But of course, they’re relying on this, big time, to balance the books.

In an IHT scenario, imagine a cash estate valued at £400,000 today, with £75,000 potentially liable to IHT at 40%. That would generate an inheritance tax bill of £30,000.

If that estate grows at 2.5% for the next 5 years, it will be worth about £452,000 by 2030. At that point, £127,000 would be subject to IHT with a bill of £50,800.

Summary

Fiscal drag may not be an every-day topic of conversation, but its effects are far-reaching and stealth-like. Freezing allowances in times of inflation and rising property values means that more income and assets fall into taxable bands.

This hidden tax burden particularly impacts those on middle to higher incomes, and families with estates that fall into the Inheritance Tax net.

While fiscal drag is often politically easier to implement than explicit tax hikes, its impact is significant.

For individuals and couples, understanding these impacts is crucial for effective financial planning. With some careful thought and proactive steps, you can help mitigate the effects of fiscal drag.

Get in touch if you’d like to chat about how all of this impacts upon your unique situation.

Production

Production