Financial planning with lifetime cashflow modelling has inspired thousands of individuals and couples to make bold, life changing decisions. From early retirement and ‘once in a lifetime’ holidays to creating new businesses and finding better work-life balance, it can bring clarity. So how might cashflow modelling help you shape the life you really want?

The Covid-19 pandemic prompted something of a shift in attitudes towards work and life in general. Millions of workers across the world are re-thinking career choices and finding new ways to make the most of their time on this planet. More and more ‘side-hustle’ businesses are popping up as people follow their passion and earn money doing what they love.

“The Great Resignation” is upon us and a study in the UK last year showed that almost 1 in 4 workers were planning to change jobs. In the US, 17.9 million workers quit their jobs between January and May 2021.

For some, a complete change in vocation is the goal. Others feel a need to accelerate their career or perhaps start their own business. Many just want to work less hours or reduce their responsibilities.

The pandemic has reminded us that life is too short and we need a better work-life balance.

The stumbling block often comes down to money. What happens if you leave a secure job with a regular salary? Could you afford a reduction in pay to free up more leisure time? How would that affect your pension and retirement plans?

This is where financial planning and lifetime cashflow modelling can help. This is not about sales of investments and pensions, but rather, creating a picture of your future financial trajectory.

What is lifetime cashflow modelling?

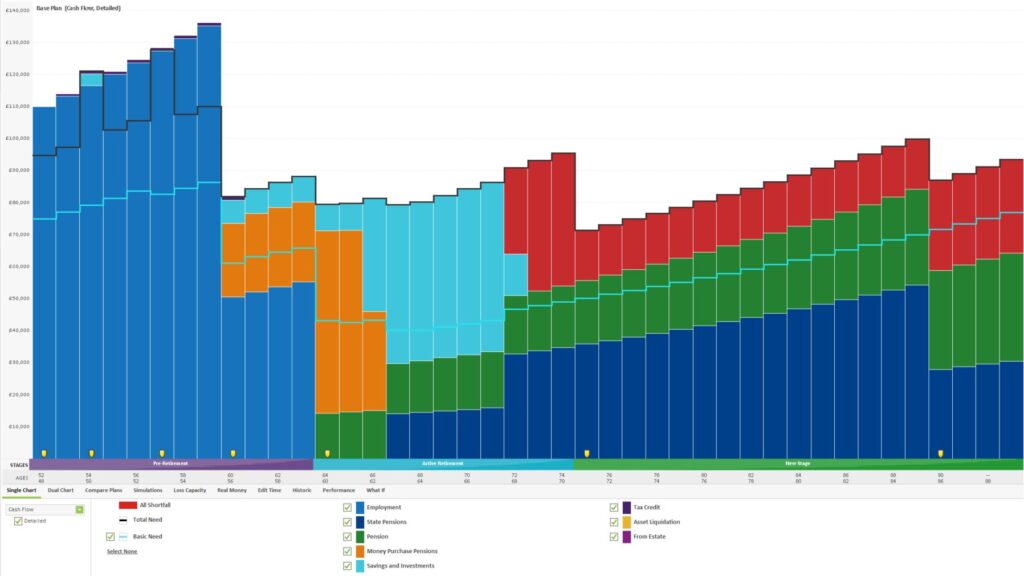

Think of it as a visual representation of your financial future. It can be done using something as simple as a spreadsheet, or with a financial planner using sophisticated software. The image below gives an idea of what you might expect to see. It shows the annual cashflow for a couple, currently aged 52 and 46, right up to their 100th birthdays.

The various coloured columns represent the source of their income each year to meet projected spending. For example, pensions, savings, investments, or the sale of property. Red highlights a potential problem. In this case, the clients are projected to run out of savings at ages 72 / 68. Armed with this information, they can take action now, before it’s too late.

How could cashflow modelling help you?

Have you ever wondered if you’re on track for retirement? Maybe you dream of stopping work a bit earlier, or possibly switching to part time work? In fact, there are loads of questions you could ask about your financial future:

- Can you afford your dream holiday of a lifetime?

- Could you buy a motorhome, a boat or holiday home when you reach retirement age?

- What happens if you take a year off to spend time with family?

- How would retirement be affected if you switched to a less stressful job?

- If you started a new business, how might that affect your finances?

- What would be the financial implication if you or your partner died?

- Do you have an inheritance tax problem building up?

- Should you overpay the mortgage or is it better to invest?

- What would happen if the stock market crashed?

These can be difficult questions and you might banish thoughts like this to the back of your mind because the answer is too tricky to work out. But with good cashflow modelling tools, you can test the financial implications of questions like this.

‘What If” scenarios create a visual graph to help make big lifestyle decisions. It’s not uncommon for individuals and couples to realise that they could afford to retire earlier than they thought.

Others, of course, realise that things are not shaping up well and that they need to take action. The earlier this becomes apparent, the better. The cost of delay in financial planning can be frightening. Here’s a quick example:

Stacey is age 40 and decides to save £250 per month. At age 65, she would have £174,469, based on various assumptions.

If she delayed just 5 years and started saving at age 45 instead, she would end up with just £116,978.

So Stacey’s cost of delay would be £57,491.

You can try out your own ‘cost of delay’ calculations here.

Choose your favourite future

In his book, “ROAR into the second half of your life (Before It’s Too Late)” Michael Clinton talks about the concept of choosing your favourite future.

Cashflow modelling helps you make choices by creating alternative visual graphs. You can play with different “What If” scenarios and test the financial outcome of different life choices.

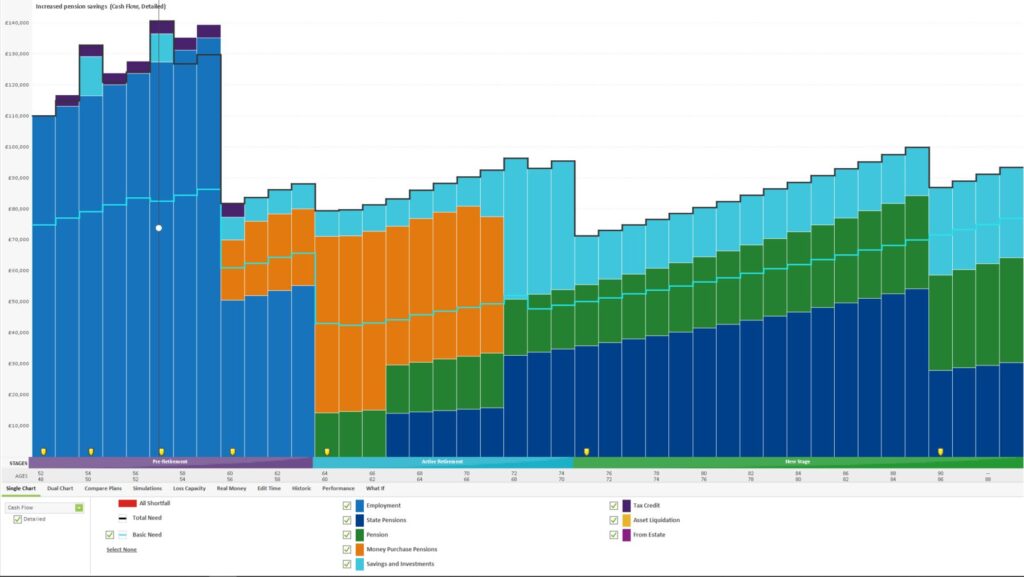

For the couple we looked at earlier, aged 52 and 46, their cashflow suggested running out of savings at ages 75 / 71. They can make some choices to improve that situation, such as:

- Retire at a later age

- Lower their lifestyle aspirations

- Save and invest more

Let’s say they’re set on their planned retirement age and really don’t want to reduce their standard of living in retirement. If they increase pension contributions instead, this can have the effect of eliminating the projected shortfall. The revised cashflow model below shows the improved situation, with no red.

How to get a picture of your financial future

Despite the fantastic advantages of cashflow modelling, relatively few people have experienced it.

It’s estimated that less than 10% of the population work with a financial planner or adviser, the majority of whom are already pretty wealthy. So how can everyone else get access to cashflow modelling?

It is possible to access a few basic “DIY” cashflow modelling tools, if you’re willing to try this on your own.

HapNav and Truth About Money offer access to “DIY” modelling and you can try them out at no cost, at least for a trial period.

Take care, though. There are some limitations and potential pitfalls when using cashflow modelling software:

- Future projections will always change. That’s because there are lots of variables like interest rates, inflation, investment growth and many others. Plans should be updated regularly.

- The data is all based on numbers so ‘garbage in = garbage out’. It’s easy to make mistakes when interpreting and keying in your financial information, so accuracy is key.

- Plans need to be reviewed regularly. Due to the inevitable ups and downs of life, things will change unexpectedly. It’s important to update your cashflow plan as your circumstances change.

If this all sounds a bit too much, you could engage the services of a financial planner. Many financial advisers will offer cashflow modelling, perhaps as part of an overall package based on a % of your overall assets. Some will create a financial plan for a one-off fee, typically between around £1,500 and £3,000, sometimes more, depending on the complexity of your situation.

Some financial coaches may also offer cashflow modelling, without the additional cost of regulated advice on specific investments. This could be an excellent option for those who want help with the big lifestyle decisions, but don’t yet have a need for wealth management.

Interested?

I founded GroWiser Financial Coaching to bring together my skills as a trained financial coach and a Chartered Financial Planner. I can work with you to create a comprehensive life plan, with no attachment to product sales or financial advice. This focus on the planning, rather than financial products, enables more cost-effective way to plan your future without the fear of being ‘sold’ to.

I work with a limited number of individuals and couples at any one time and we work to your timescales. That allows plenty of scope to explore different ‘What If’ scenarios and ultimately, to Design Your Future.

If you’d like a chat to find out more, just click below to book a 30 minute meeting over Zoom. Or if you’re not quite ready for that, why not subscribe to my weekly newsletter for regular updates on money and life planning.

Production

Production