If you think of what financial coaching could entail, you might imagine diving straight into spreadsheets, budgets, and savings plans. But before getting into the practicalities of money, there’s something even more important to consider: the shape of your Wheel of Life.

Money is never just about dollars, pounds or whichever currency you use. It’s also about time, designing the life you want to live and creating the balance you’re striving for.

The Wheel of Life is a simple yet powerful coaching tool that helps you visualise a holistic snapshot of your life as it stands today. By reflecting on key areas like relationships, health, career, fun and personal growth, the Wheel of Life helps you see where you’re thriving and where you might need more attention.

Since money weaves its way through all aspects of life, it can often feel overwhelming. There are so many things to consider. Gaining clarity on where you’re at now and where you’d like to be in the future is a crucial first step. It helps you to break down that sense of overwhelm and prioritise things into bite-sized chunks. Importantly, it allows you to create a plan that’s unique to you.

In this article, I explain how and why I begin with the Wheel of Life when working with new individuals and couples. By starting with a big-picture view of your life, we can ensure that your financial goals are aligned with what truly matters to you.

There’s no point in climbing the financial ladder, if it’s propped up against the wrong wall!

What is the Wheel of Life?

The original Wheel of Life, also known as the Bhavacakra, is a visual representation of Buddhist teachings that originated in India. Legend says that the Buddha created the first depiction of the Wheel of Life and the earliest known version is in the Ajanta cave complex in south India.

The modern-day Wheel of Life tool was created in the 1960s by Paul J. Meyer, founder of the Success Motivation Institute.

It’s a much simpler circle that represents the most important aspects of life, such as family, health, career, and finances. It’s also known as the “life balance wheel,” “the coaching wheel,” or the “life wheel”.

There are many different variations of the Wheel and it can be used and interpreted in different ways. The version I use is divided into eight segments, each representing a key area of life:

Significant Other

Your romantic relationship or the importance of having one – or not having one – in your life.

Personal Growth

Your learning, sense of purpose and spirituality.

Fun & Leisure

The time you spend enjoying life and doing things that bring you joy.

Home Environment

How comfortable, safe, and happy you feel in your living space(s).

Career

Your satisfaction, progress, and fulfilment in your professional life, or giving back to others if not working.

Money

Your financial stability, plans for the future, habits and emotions around personal finance.

Health

Your physical and mental wellbeing.

Friends & Family

The quality of your relationships and connections with loved ones.

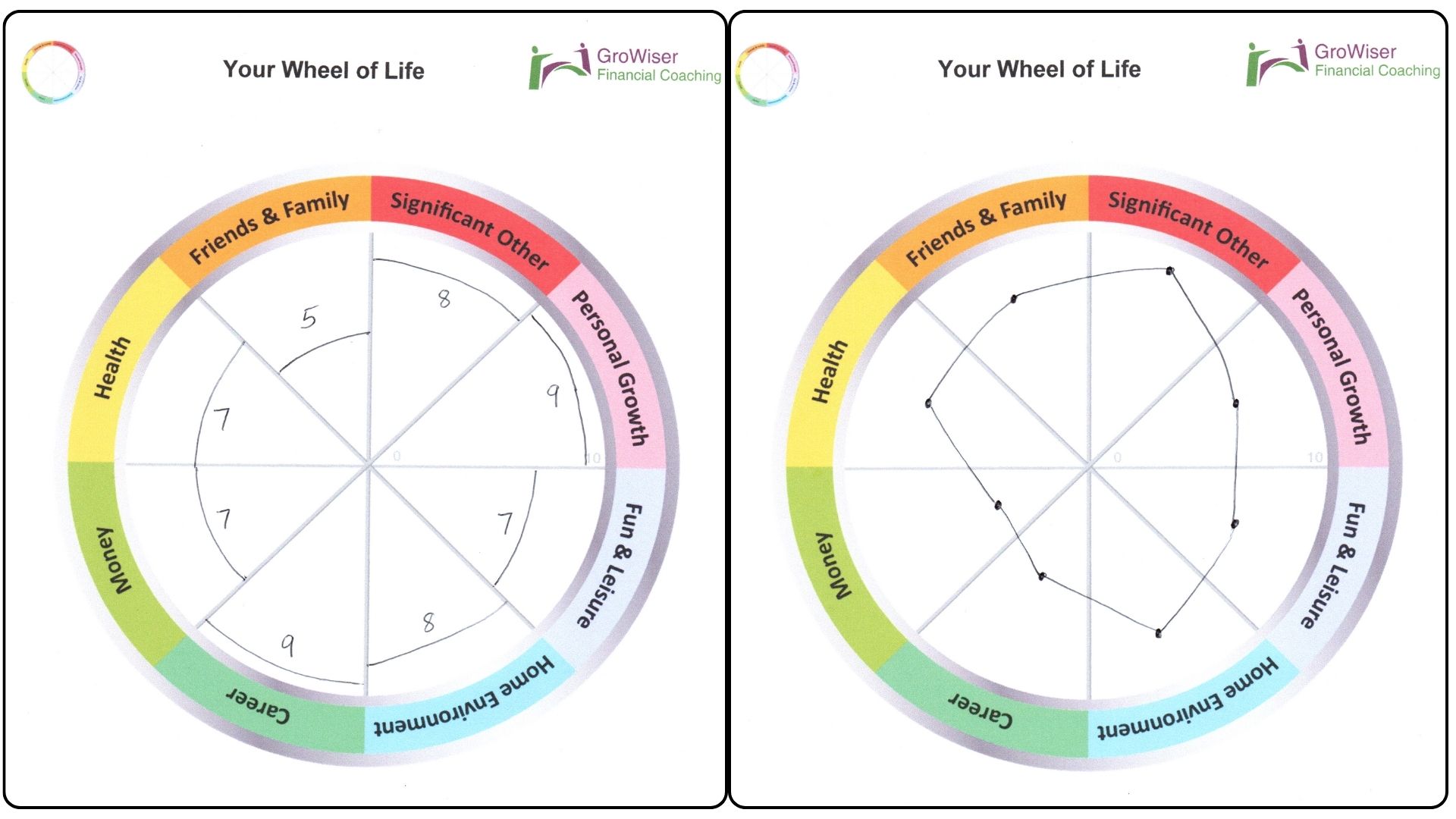

To use the Wheel of Life, you rate your satisfaction in each of these areas on a scale from 1 to 10, where 1 is very dissatisfied and 10 is fully satisfied. Then you plot those ratings on the wheel to create a visual representation of your life.

The result often looks like a lopsided circle, which highlights areas where you may feel out of balance. Sometimes, you can have a well-rounded circle, but with lower scores than you would like. In this case, you could reflect on which segments you would most like to improve first.

What makes the Wheel of Life so effective is its simplicity. It’s not about achieving perfection in every area. It’s about recognising where you feel most comfortable and identifying areas that might need more focus. From a prioritisation point of view, it helps put things into perspective, allowing lower priority areas to be set aside for another day.

In the context of financial coaching, the Wheel of Life is invaluable because it reveals how your finances are intertwined with other aspects of your life.

Why start with the Wheel of Life in Financial Coaching?

Money doesn’t exist in isolation. It touches every aspect of our lives and often, can be a key source of stress and overwhelm.

The Wheel of Life helps uncover your true priorities, without being distracted by the immediate financial dilemmas on your mind. It gives you a holistic view of where you are right now, highlighting which areas of life matter most.

For example, if you’re deeply unhappy with your career or experiencing strained relationships, those areas might need to take precedence before you can fully focus on your financial goals.

On the other hand, money conversations can sometimes lead to a solution. If you’re in a job that you really don’t enjoy, could financial planning support a move to a job that you love, even if the pay is less?

Or if relationships are strained, could this be down to money? How harmonious are financial conversations with your partner? This is often something that couples identify as having room for improvement.

By addressing the root causes of stress or dissatisfaction, you create a stronger foundation for meaningful progress.

Starting with this exercise also enhances self-awareness. It helps you connect your financial goals with your broader life aspirations. For instance, if you score “Fun & Leisure” with a low number, you might decide to prioritise budgeting for more travel or hobbies.

Or, if “Personal Growth” is an area you want to improve, you could allocate resources toward education or skills development.

This makes the financial coaching process far more personalised and impactful. Ultimately, the Wheel of Life helps to design a financial plan that works uniquely for you, not just for your bank account.

A step-by-step overview

If you’d like to try the Wheel of Life, download a PDF copy of the template and follow these steps:

Step 1: Think what satisfaction looks like for you

Rate your level of satisfaction in each segment on a scale from 1 to 10:

- 1 means you’re completely dissatisfied or feel that area needs urgent attention.

- 10 means you’re completely satisfied and wouldn’t change a thing.

For example, if you feel your career is going well but there’s room for growth, you might rate it a 7. If your health is a major concern, you might rate it a 3.

Don’t spend long trying to think of the right number. Just use the first number that pops into your head – and don’t use the number you think it should be!

Step 2: Plot Your Ratings

As you assign a score to each segment, plot the number on the Wheel. You could mark a dot in each segment, then connect the dots to create a shape. Or you could draw a line across each segment, as shown in the examples below:

Step 3: Visualise the Balance

Take a look at the shape you’ve created on the wheel. Is it a smooth, balanced circle? Or does it look more like a jagged, uneven figure?

Most people find that their wheel is lopsided, with some areas scoring high and others much lower. This imbalance is completely normal. It’s simply a visual representation of where your attention and energy might need to be focused.

Step 4: Reflect on the Results

Now that you have a clear picture of your current balance, it’s time to reflect. Ask yourself:

- What stands out the most?

- Which areas are thriving, and which need more focus?

- How do these imbalances affect other areas of your life?

- Which areas are most important to address right now?

Step 5: Set Priorities and Goals

The final step is to prioritise and set actionable goals. Rather than trying to tackle everything at once, focus on the areas that matter most to you.

For instance, if improving your health is a priority, you might explore how your finances can support better nutrition, fitness, or medical care. If relationships are a focus, you might consider budgeting for date nights or family activities.

Often, ‘Money’ itself can be the lowest score and can uncover various personal finance topics that need attention. I use a similar “Wheel of Money” exercise to drill into this in more detail.

Talking about money can reveal desires to improve areas from day-to-day budgeting and money management; long-term financial planning; retirement planning and career changes to improving your relationship with and emotions around money.

For many, the real value of the Wheel of Life comes not from allocating the scores, but by talking to someone else about it. Clients are often surprised by the additional insight and clarity that emerges by talking out loud to someone who can listen in an impartial and non-judgemental way.

When used at the beginning of a financial coaching journey, it really helps to set the context for future sessions. It’s why I offer this as a standalone service. It really helps uncover the nature and scale of what you’d like to achieve. It can also help to confirm whether or not financial coaching is the best approach.

90-minute Life Balance Consultation

Most new clients I work with begin their journey with a standalone ‘Life Balance Consultation’. This is a 90-minute session for individuals and couples, where we focus on the Wheel of Life and usually, the Wheel of Money too.

The session brings new insights and clarity around what you’d like to achieve through working with a financial coach. Importantly, it also helps you to prioritise topics and create a roadmap that’s unique to you and your circumstances.

From there, you may move on to complete a 3, 6 or 9 session financial coaching programme. Other times, the priority will be more around long-term financial planning and lifetime cashflow modelling. Either way, this initial session, using the Wheel of Life, helps identify the end goals and establishes what a great outcome would be for you.

Life Balance Consultations are currently £150 but all new enquiries begin with a 30-minute initial chat at no cost to you. This helps to ensure we’re a good match before getting into detailed discussion.

You can book a free 30-minute chat by getting in touch below.

Production

Production