Do you ever find yourself torn between two conflicting desires – enjoying life now but also securing your future? It’s a common challenge, especially when financial pressures and societal expectations push you to live in the moment. This is when a spending plan can be valuable. Think of it as a tool that enables you to enjoy your hard-earned money today while also setting aside resources for tomorrow.

What is a Spending Plan?

While the thought of ‘budgeting’ may feel restrictive, a spending plan focuses on empowering you. It allows you to allocate your money in a way that reflects your values, ensuring you strike a balance between immediate gratification and long-term stability.

Budgeting can feel like sacrifice; a spending plan feels like control.

With a spending plan, your money is directed with intention. Whether it’s indulging in experiences now or investing in your future, the plan ensures that you’re conscious of your decisions and that your spending aligns with your personal goals.

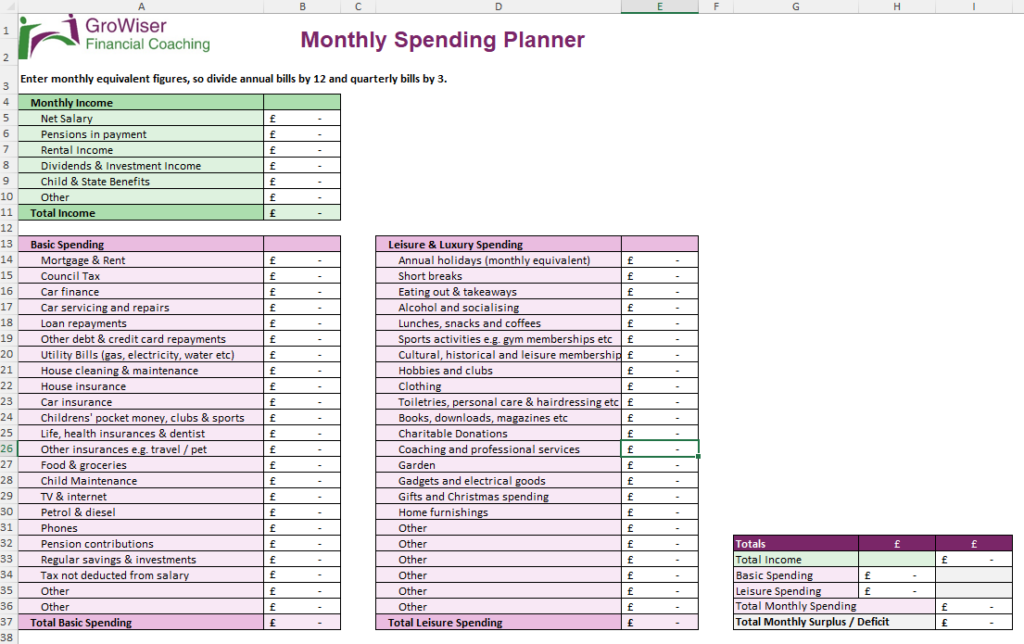

From a practical point of view, a spending plan can look like anything you want. You might create one using whiteboards on the wall, it could be one of the many digital apps available these days, or it could be a good old-fashioned spreadsheet.

If you like the spreadsheet idea, you can download a copy of this one by clicking the image below 👇

With this spreadsheet, you can personalise all the spending categories to suit yourself. The idea is to note your monthly income in the green section, then add all your average monthly expenses in the pink sections.

The spreadsheet will automatically add up the totals and indicate whether you have a monthly surplus or a deficit.

The Power of Balance: Fun Now and Security for Later

One of the key philosophies of a spending plan is balance. It encourages you to think about how to embrace both the joy of the present and the peace of the future:

Prioritise What Brings You Joy Today

Start by reflecting on what truly adds value to your life right now. Whether it’s travel, dining out, or investing in hobbies, a spending plan allows for these pleasures in a way that won’t jeopardise your future.

Ask yourself: What are the things I love doing that make me feel fulfilled? How can I plan for them?

Automate for Your Future Self

Just as you set aside money for current joys, automate your savings and investments for the future. By building this habit, you create a financial cushion for later without having to make day-to-day decisions about it. This might include setting up automatic transfers to an ISA or pension.

Think of this as “paying your future self” first. You can read more about the concept of Pay Yourself First in my earlier blog post.

Practical Steps to Embrace a Spending Plan

Evaluate Your Current Financial Habits

Begin by reviewing your current spending patterns. Look back at your bank account and credit card statements for three months or so and note down your average spending by category. A good way to capture this can be to use the spreadsheet above 👆.

Don’t forget to build in allowances for those occasional expenses that crop up every so often, like Christmas, house maintenance and car repairs.

Then ask yourself if your spending is aligned with your values and long-term goals? Identify areas where you might be overspending or not setting enough aside for the future.

Set Clear Financial Goals for Both Present and Future

Now that you have a record of past spending, it’s time to create a Version 2 – or a ‘Plan B’. This time, rather than analysing the past, plan for how you would like your spending to look.

Your spending plan should reflect both short-term and long-term goals. You might find it helpful to set measurable targets for both, whether that’s an annual holiday, a new gadget, or a specific retirement milestone.

Divide Your Spending into Priorities

Allocate portions of your income to different sections:

- Basic Spending: The things that you don’t really have much choice over. Rent or mortgage, household bills, groceries, travel and debt repayments.

- Leisure and Luxury Spending: This is your discretionary spending where you do have a choice. Dining out, entertainment, hobbies, charitable donations etc.

- Future Self: This could sit within either of the above categories. For example, you might need to allocate budget toward your basic future spending – pension contributions, for example. On the other hand, you may also want to find savings and investments for future luxuries, like extensive travel or even the ability to switch from full-time to part-time work.

The goal is to ensure that both “Fun Now” and “Future Security” are proportionally catered to.

Consider the 50/30/20 Rule as a Guide

A simple guideline to follow could be the 50/30/20 rule:

- 50% for basic spending (housing, utilities, groceries).

- 30% for leisure and luxury.

- 20% for future investments (savings and investments).

This will vary depending on your unique circumstances, but it’s a decent starting point for crafting a plan that works for both now and the future.

The Practicalities of Executing Your Spending Plan

It’s vital to remember that creating a Spending Plan is only half the battle. Next, you need to find a way that allows you to stick to it. In my experience, this is where plans can fall apart.

It’s the action part of a spending plan that I might typically describe as “budgeting”. What daily thoughts, actions and habits will help you to stay on track and not deviate from the plan?

For more about budgeting techniques, you can read my earlier blog “4 Ways to Make Budgeting Effective and Fun”.

You may also have unhelpful habits and beliefs around money that make it difficult to control your spending. This is where working with a financial coach can identify specific behaviours and build techniques and motivation that are specific to you.

If you’d like to speak with a qualified and experience financial coach about this, get in touch here for a 30-minute chat at no cost to you.

Your Future Self Will Thank You

It’s easy to underestimate the compounding effect of small but consistent financial decisions. By choosing to invest in your future today, you’re essentially giving your future-self freedom, peace of mind, and the ability to maintain your lifestyle even when you’re no longer actively earning.

A spending plan isn’t just about managing money, it’s about living a balanced, fulfilling life. It allows you to enjoy the present moment without the guilt of neglecting your future.

By embracing a thoughtful, values-driven spending plan, you’re ensuring that you can have fun now while still taking care of the person you’ll be years from now. And that balance is where true financial freedom lies.

Production

Production