Coaching-led financial planning is not a term you’re likely to be familiar with. The whole point of coaching is not to be led, but rather, to feel empowered to create your own path to success. So what does it mean?

Well, traditionally, the creation of a financial plan tends to involve the help of an expert, ideally a Chartered or Certified Financial Planner. This ensures that adequate knowledge and experience is in place, although it can create a dependency on the expert to lead the way.

The question is, would you rather devolve your financial planning to someone else, who can choose products and manage money on your behalf? Or would you prefer to take control of your own financial plan and develop the knowledge and skills to feel financially independent?

There is no right or wrong answer to this question. Many individuals and couples do not have the time or the inclination to manage their own money. And for some, their situation can be sufficiently complex to warrant having a team of experts on their side.

But let’s assume, for a minute, that you like the idea of being your own financial planner. What could be the benefits of working with a financial coach to make this happen?

Empowerment Through Education

A coaching-led approach to financial planning places a strong emphasis on building your knowledge of money. Rather than simply offering advice, a financial coach will work alongside you to deepen your understanding of financial principles.

This educational focus empowers you to make informed decisions and fosters long-term financial literacy. Over time, the knowledge and skills you build will lead to greater financial confidence and independence. This helps you take control of your financial future with clarity and purpose.

This concept of personal development and growth contributes to a sense of financial freedom, where you’re not perpetually dependent on others for advice and guidance.

Tailored Support for Unique Financial Journeys

Every individual and couples’ financial journey is unique, and a one-size-fits-all approach rarely works.

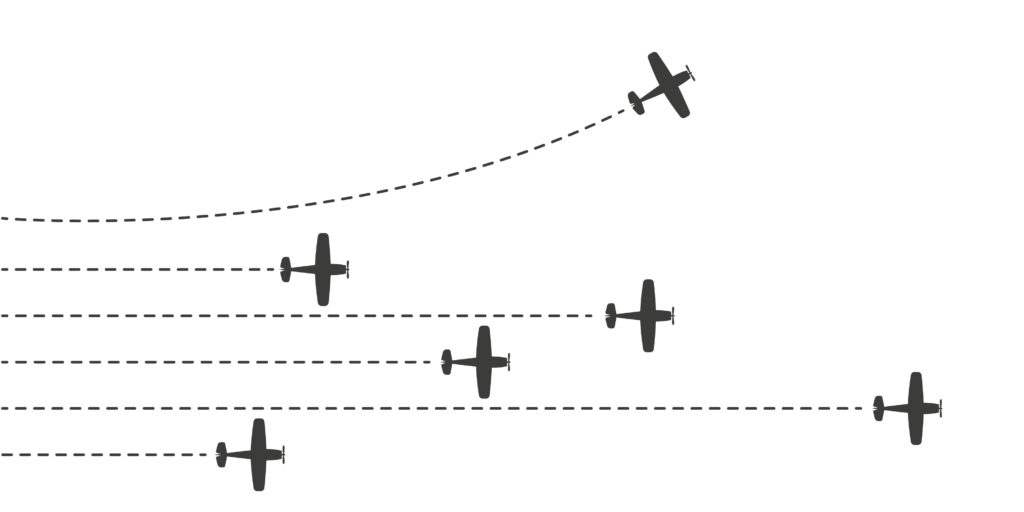

A coaching-led model is inherently flexible, allowing for personalised strategies that reflect individual circumstances, goals, and challenges. You should not feel as though you’re being forced through a “sausage-machine” process.

Whether you’re a freelancer navigating variable income, a small business owner planning for growth, or someone working towards a career change or early retirement, a coach can help you design a financial plan that aligns with your specific lifestyle aspirations.

With coaching-led financial planning, it makes no difference your current level of wealth. A coach has no products to sell or commissions to earn. It’s about you, not your money.

Holistic Focus on Financial Wellbeing

Coaching-led financial planning goes beyond the numbers. It considers the psychological and emotional aspects of financial decision-making.

When appropriate, discussions and exercises can help you address issues like spending habits, money mindset, habits and attitudes.

By focusing on holistic financial wellbeing, you don’t just work towards your financial goals. It also enables you to cultivate a healthier relationship with money, leading to more sustainable financial habits over the long term.

Cost-Effective and Accessible

Coaching-led financial planning sits outside the scope of regulation by the Financial Conduct Authority.

This is not about the sale or recommendation of specific products, nor is it about someone else managing your money on your behalf. Because this approach to financial planning is not subject to the same regulations as traditional financial advice, it can be delivered at a lower cost.

It also doesn’t matter if you have not yet accumulated significant wealth. Financial coaches will not charge percentage-based fees in the way that most financial advisers do. This makes it more accessible to a wider range of individuals and couples, including those who may not have the resources to engage with regulated financial advice.

A coaching-led approach will often provide ongoing support and guidance too, helping you stay on track without the hefty percentage-based fees associated with regulated financial services.

Accountability and Ongoing Support

One of the standout benefits of a coaching-led model is the emphasis on accountability. Financial coaches work closely with clients to set clear, actionable goals and provide the support needed to stay on track.

Regular check-ins and progress reviews can help you stay focused and motivated. This continuous support is crucial for building momentum and achieving long-term financial success.

It takes more effort, of course. This is not an approach where you have one annual meeting and an adviser takes care of everything for you. This is about taking control of personal finance yourself and creating your own sense of independence and freedom.

A Collaborative Approach

Unlike regulated financial advice, coaching-led financial planning cannot provide a service of managing investments on your behalf.

Financial coaches collaborate with clients in an interactive and engaging way and, sometimes, that can involve working with you to identify a suitable regulated adviser to take care of your investments.

This collaborative approach ensures you are intrinsically involved in the financial planning process. It fosters a deeper connection to your financial goals and a greater sense of ownership over your financial decisions.

Summary

A coaching-led approach to financial planning offers a unique blend of education, empowerment, and personalised support that can transform the way you plan and manage your finances.

By focusing on holistic financial wellbeing, coaching can help you not only achieve financial goals, but also develop the skills and confidence needed to sustain a feeling of financial freedom over the long term.

Whether you’re just starting your financial journey or looking to refine your existing strategies, a coaching-led approach to financial planning could be the key to unlocking your full financial potential.

Find out more about my financial planning packages here and if you’d like to discuss the possibility of working with me, why not arrange a half-hour initial chat?

Production

Production