Financial independence sounds good, but are you confident that you know what it means? And how does it differ to that other phrase “financial freedom”?

There isn’t really a formal definition for either. Spend a little time researching and you’ll find several descriptions for both.

Broadly speaking, financial independence means you have enough assets to generate sufficient income to support your living expenses indefinitely. You don’t need to choose an extravagant lifestyle, but work would become optional.

Assets that can help achieve this include pensions, stocks and shares, rental properties and maybe business profits if you own a business but don’t need to spend your time working in it. Royalties from creative work are another example.

Possessions like your home, vehicles, holiday home, gadgets and collections of art etc will generally not help towards financial independence.

Note that you can become financially independent with quite a modest lifestyle. It’s not necessarily about getting super rich. It’s more about getting to the position where you no longer need to exchange your time for money.

What about Financial Freedom?

So what about financial freedom? For many, this has a wider meaning. There are thousands of people who are financially independent, yet do not feel financially free. That could simply be because they don’t yet realise they have enough money for the rest of their life.

As a result, even financially secure people can feel anxious and stressed. They live in fear that, one day, they’ll run out of money. Sadly, this can mean not living life to the full and regrets may creep in during later life. See my blog about the biggest end-of-life regrets for more about this.

Financial freedom implies having enough money to live an unrestricted life, where work is optional. You would have the flexibility and confidence to make choices on how to spend your time. Financial decisions could be made with ease and you would generally be stress-free around money.

But let’s not get ahead of ourselves. This article is about financial independence, which itself, is a vital step on the way towards financial freedom.

It may feel a long way off, but if you carry out the following 6 action points, you’ll at least be on the right track.

1. Envisage your minimum, desired lifestyle

First of all, start with the end in mind. You need to have a pretty good idea of how you would like life to feel, after achieving financial independence. It doesn’t have to be extravagant, but you will want to feel comfortable and happy.

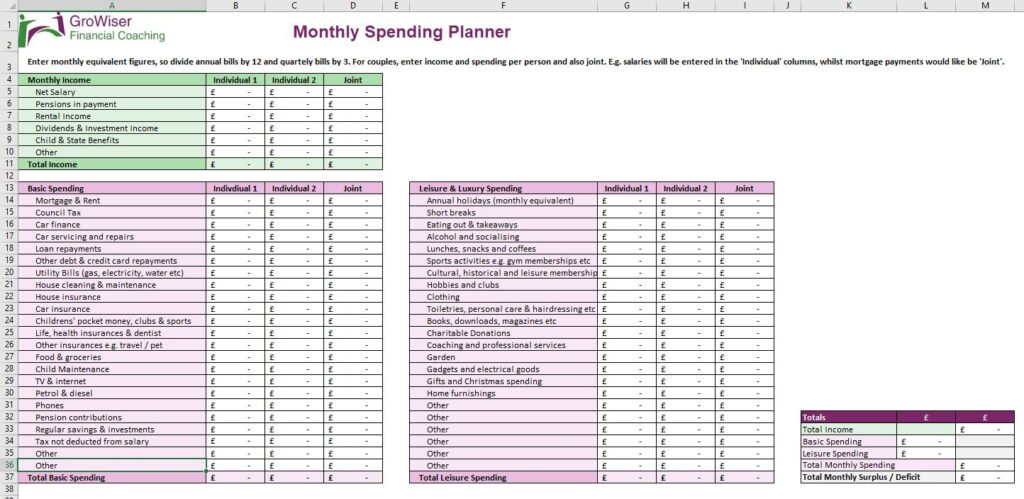

A good starting point is to create a detailed breakdown of what you spend now. Think about how much goes on food and drink, house and vehicle maintenance, hobbies and travel.

You don’t need to include loan or mortgage payments. To keep things simple, let’s assume that you’ll repay these debts on the way to financial independence. You can also deduct commuting costs and other work-related expenses. Once you achieve financial independence, you’ll have the option to stop working for money.

Don’t skimp too much on leisure costs, personal development and community involvement. Although you don’t necessarily need to live an extravagant life, you’ll still need to look after your social, physical and community wellbeing.

Think about how you would find purpose to your life if you did choose to stop working. Ask yourself questions like:

- What would you do?

- Where would you go?

- Who would you spend your time with?

- What would make you feel happy?

2. Work out the cost of your desired lifestyle

Once you have an idea of how you would spend your time, you need to calculate the cost of that.

Don’t feel that you need to add expensive, aspirational purchases for the time being. This exercise is about working out what you need to become financially independent from paid work. It’s not necessarily about living a life of luxury.

Let’s call the cost of your desired lifestyle your basic income requirement.

It might help to complete a spending plan for this exercise. Think of it as a ‘future budget’ to help break down where your money would go if you woke up each day with no need to go to work.

If you’d like a copy of the Excel Spending Planner below, download them here

3. Take account of expected, guaranteed income

Next, take account of any ongoing income that would continue, even if your wages or salary stopped. This could be a ‘final salary’ pension, rental income or maybe even a share of business profits.

Depending on when you hope to achieve financial independence, you could even include the state pension. Of course, that would assume that you’re thinking beyond age 66, or later, depending on your age now.

Whatever guaranteed income you expect in the future, deduct this from your basic income requirement. Remember, if you’re taking account of a final salary pension here, check that it’s due to begin before you want to achieve financial independence.

Don’t worry if you have no existing income to allocate at this point. You’re not alone. With the demise of final salary pensions, fewer and fewer people will enjoy guaranteed income in retirement. Hence the need to plan for financial independence in the first place!

4. Calculate your financial independence number

Assuming you’ve followed the steps above, it should now be pretty clear how much money you need to maintain a decent standard of living.

Calculate your Financial Independence Number

If you’ve worked this out on a monthly basis, multiply it by 12 so you have an annual basic income requirement.

Your financial independence number (FIN), as a ‘rule of thumb’ is your annual basic income requirement multiplied by 25.

This number is the amount of income-producing assets you need for work to become optional. It’s based on the assumption that you can generate an annual return of 4% on your assets.

FIN = (Your Annual Basic Income requirement x 25)

For some people, this could be a scarily high number.

For example, let’s say you need to spend £2,500 per month, or £30,000 a year to enjoy a comfortable life. Your financial independence number would be 25 x £30,000 = £750,000.

Don’t let this put you off. Your pension funds, savings and investments, maybe even equity in your home if you plan to downsize at some point, can all go towards this number.

5. Calculate your investible net worth

Now that you know your financial independence number, you need to understand how much additional effort is required to get there.

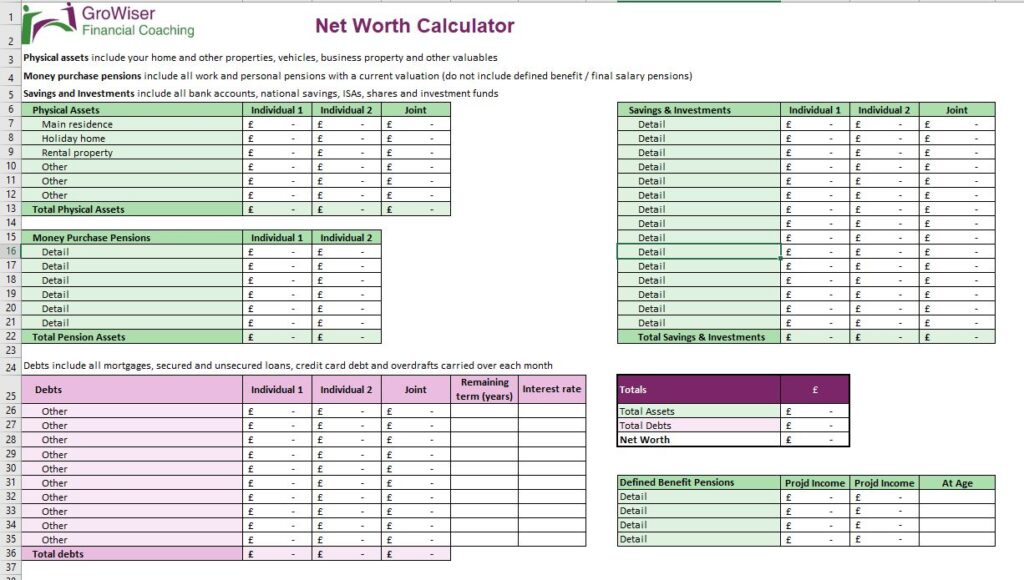

It’s good financial housekeeping to keep tabs on your net worth every so often. This means adding up all your assets, then deducting all of your debts. You can download a Net Worth Calculator here:

GroWiser Net Worth Calculator

For the purposes of financial independence, only include your investible net worth. That means assets that can produce an income. Leave out the value of your home and other possessions that don’t produce a reliable income.

Compare your investible net worth against your financial independence number and you’ll either have a shortfall or a surplus.

If you have a surplus, congratulations. You’re on track to contemplate the benefits of financial freedom.

If you have a shortfall, you’re in the majority. You should now take the opportunity to begin planning more purposefully.

6. Reduce the shortfall

Very few people achieve financial independence at their age of choice. But with enough time, patience and self-discipline, it’s possible. You might need to make some different lifestyle choices now, but remember, this is about investing for your future self.

For ideas on how you can build up capital and move closer towards financial independence, see my article 5 ideas on how to nurture your wealth.

Nurture Your Wealth

As the saying goes, “The journey of a thousand miles begins with one step”. It’s important that you take that step, however small. Or you’ll certainly never get there.

Don’t forget the bigger picture

Everyone will have different thoughts, emotions and opinions on the concept of financial independence. If you aspire towards work being optional, try to remember that it’s not all about the destination. The journey is just as important.

By focusing solely on investing, it can be easy to neglect the basic building blocks of good financial planning. You need to protect you and your family from unexpected bumps along the way. Read about 5 ways to protect your family and make sure you take a balanced approach towards financial success.

This might all sound a bit much if it’s new to you, but never hold back in asking for help. Your future self will thank you.

Production

Production