Confidence with money is not especially high in the UK. 39% of adults don’t feel confident managing their money, according to the Money & Pensions Service.

The Financial Capability Survey found that:

- 55% of workers do not feel they understand enough about pensions to make decisions about retirement

- 63% feel they cannot determine what happens in their lives when it comes to money

- Only 52% of 7 to 17 year olds say they receive meaningful financial education at home, at school on in other settings

- 11.5 million people in the UK have less than £100 in savings

- Nearly 9 million people are in serious debt, with only a third receiving help

Worryingly, it’s not just a lack of confidence that can cause problems. 27% of working adults were shown to be over-confident in their ability to use numbers in everyday life. This raises the prospect of making financial mistakes and poor decisions.

So what can you do to improve your confidence with money? Here are 7 ideas to get started.

1. Develop your financial knowledge

Financial literacy is at the core of having confidence with money. If you have a good grasp of the basic financial concepts and skills, then you’re on the right track.

One significant challenge is that we leave school woefully underprepared in this area. The curriculum is not geared towards developing your knowledge and skills around money management. As a result, many of us leave school, only to develop poor money behaviours.

We end up guessing our way through financial life.

Fortunately, there is almost unlimited information available to help with this. Books, podcasts, YouTube videos and blogs are widely available, much of it for free. One challenge can be filtering through the c**p to find the good stuff.

A good place to begin is Pete Matthew’s Meaningful Money podcast, blog and YouTube channel. Over the years, Pete has developed material on just about anything you need to know, when it comes to money.

Resources like this can help develop your knowledge. However, knowing your stuff is not enough. Building positive habits, skills and motivation can be more of a challenge. So keep reading.

2. Build an emergency fund

In the UK, a third of us have less than £600 in savings. Most households fall well short of having the recommended 3 to 6 months of expenditure saved for emergencies. As a result, people can live in fear of a financial emergency, which really puts a dampener on financial confidence.

Building up an emergency fund doesn’t just have the obvious practical benefits. It can help provide a real psychological boost and allow you to concentrate on other things.

For more ideas on this, read my article “3 steps to build an emergency fund and keep it separate from rainy day fun money”.

3. Discover your money beliefs

Did you know that most of your beliefs around money are formed by age 7? Those beliefs form into habits and attitudes that continue into adulthood. And not all of them are healthy. Which do you recognise:

- “money doesn’t grow on trees”

- “rich people are greedy”

- “money makes the world go round”

- “money can’t buy happiness”

- “money is the root of all evil”

- “you need money to make money”

Chances are, you’ve never really thought about your money beliefs. And if you have a partner, there’s a high chance that each of your money beliefs will be completely different. This can be a real source of anxiety and all too often, household arguments.

All these negative messages and emotions, if they apply to you, can really dent confidence with money. Learning more about your relationship with money allows you to take steps to improve.

Money beliefs are often negative

Your habits and attitudes around money are known as habitudes, a phrase coined by Syble Solomon. She’s an expert in the psychology of money and developed an online game to help understand your relationship with money.

You can read more about this in my article about money habitudes here.

4. Focus on small improvements

Don’t stress about trying to make big changes and fix everything all at once. “Progress over perfection” is a phrase used by one of my favourite managers during my years of work.

James Clear’s book, Atomic Habits, explains that real change comes from the compound effect of small decisions. If you just make a start with one small, positive behaviour, it can set off a chain reaction with spectacular results over time.

Atomic Habits by James Clear

Focus on improvements of just 1% at a time and you will make progress. Surely this must be better than making no progress at all because of overwhelm or procrastination?

5. Talk about it!

We’re particularly bad at this in the UK. It can be seen as a bit “uncouth” to talk about money. But if you think about it, how can you truly feel confident about something if you never speak of it?

If you’re a fan of Harry Potter, you’ll know that Harry and Dumbledore were pretty much the only characters to refer to Voldemort by name. “He-Who-Must-Not-Be-Named” was the phrase used by those living in fear and lacking confidence to deal with him. In a way, it reflects our collective lack of confidence in money. Only the most confident tend to speak up about it.

A good starting point is to speak with someone who is trained to listen without judgement. Financial coaching offers this opportunity.

6. Invest in a financial plan

Most people don’t have a written financial plan. It’s probably fair to say that most people don’t actually know what a financial plan is or what it might look like. It’s often assumed that it’s something only for the wealthy. But I disagree.

One difficulty in the UK at present, is that financial planning is mostly provided by regulated financial advisers. There’s nothing wrong with that in principle. But in practice, it’s usually provided alongside investment advice and not everyone is ready for that.

My view is that the creation of a financial plan is entirely separate from the recommendation of specific products. This approach opens up the concept of financial planning to everyone, no matter how much or little wealth has already been accumulated.

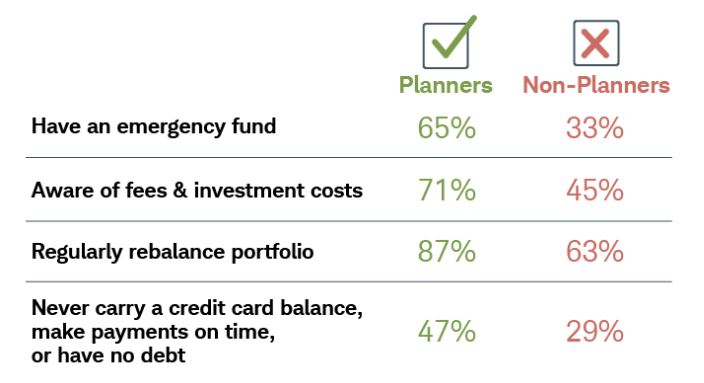

Confidence with money can be hugely improved by creating a financial plan. Research by Charles Schwab in America suggests that those with a financial plan will have better money habits than those without.

Paying for a professionally created financial plan is an investment in your future self. It’s not just about the actual numbers and the money. Crucially, it’s also about money mindset and your own confidence with money.

Click here for more details about my financial life planning service.

7. Get a coach

Everyone knows how to eat healthier, get fit and lose weight. But knowing what to do and actually doing it are very different things.

A personal trainer or fitness coach can help you to break down health targets into manageable steps. They can provide motivation, accountability and when required, expert guidance.

In a similar way, a financial coach can help you break down your money goals in a way that gives confidence and a sense of optimism. You can work alongside a coach to gain a sense of accountability and motivation, but do check that your prospective coach has invested in their own training and accreditations.

Sometimes, specialist advice may be required and if so, a financial coach can help you identify and prepare for working with specialists.

There are many steps you can take to improve your confidence with money on your own. It can take time, though. If you feel that you really need to make progress more quickly, ask for help.

Summary

Financial confidence and financial wellbeing are closely linked. As your confidence with money grows, you can expect your financial wellbeing to improve. And if that happens, you’ll likely enjoy a positive knock-on effect on the areas of career, social, community and physical wellbeing.

Taking action on the 7 steps above will certainly improve your financial confidence. But it could also improve your long-term wellbeing in so many other ways.

Production

Production